Can CBDT Chief Achieve Rs 25.2 Lakh Crore Direct Tax Collection Target for FY26?

Synopsis

Key Takeaways

- CBDT aims for a Rs 25.20 lakh crore target for FY26.

- Direct tax collection is growing at 6.99% year-on-year.

- Net direct tax collection surpassed Rs 12.92 lakh crore as of November 10.

- Refunds have decreased by 18%, aiding net collections.

- Taxpayer compliance is on the rise, boosting government confidence.

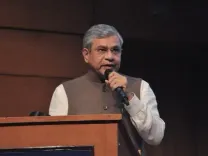

New Delhi, Nov 17 (NationPress) Chairman of the Central Board of Direct Taxes (CBDT) Ravi Agrawal on Monday conveyed optimism regarding achieving the income tax collection goal of Rs 25.20 lakh crore by the conclusion of the current fiscal year (FY26).

During his remarks at the India International Trade Fair (IITF), Agarwal mentioned that the growth rate of direct tax collection stands at 6.99 percent, compared to last year, indicating a positive trend.

"We are confident that we can meet our targets by year-end. The feedback from taxpayers has been promising," he stated.

Net direct tax collections have risen by 6.99 percent from April 1 to November 10 of this fiscal year, exceeding Rs 12.92 lakh crore, attributed to slower refunds and enhanced corporate tax collection.

As of November 10, refunds have decreased by 18 percent, totaling over Rs 2.42 lakh crore.

Agarwal also noted the extended deadline for filing audit returns for the 2024–2025 fiscal year and mentioned that two advance tax payments are still pending for the current year, suggesting that the target could be achieved by December 10.

Prior CBDT reports indicated that India’s net direct tax collection has shown a growth of 9.18 percent, surpassing Rs 10.82 lakh crore until September 17, compared to the same timeframe last fiscal year, despite a significant drop of 23.87 percent in refunds.

From the total collections, non-corporate tax revenue increased by 13.67 percent to Rs 5.83 lakh crore. This tax is applicable to certain entities that do not register as companies under the Companies Act.

Meanwhile, net corporate tax collections rose by 4.93 percent to Rs 4.72 lakh crore, and the securities transactions tax (STT) saw a slight increase of 0.57 percent to Rs 26,305.72 crore, according to official statistics. Overall, gross direct tax collections grew by 3.39 percent to Rs 12.43 lakh crore, while refunds dropped by 23.87 percent to Rs 1.60 lakh crore.