How is NITI Aayog’s policy paper addressing foreign investors' concerns?

Synopsis

Key Takeaways

- NITI Aayog's policy paper aims to enhance tax predictability.

- Focus on resolving dispute resolution issues.

- Collaboration between public and private sectors is emphasized.

- Recommendations include a new Presumptive Taxation Scheme.

- Stable tax regime is critical for foreign investor confidence.

New Delhi, Oct 4 (NationPress) NITI Aayog has unveiled a policy working paper aimed at tackling the persistent issues faced by foreign investors regarding tax predictability and dispute resolution, with the goal of enhancing India’s investment landscape.

As India progresses towards its 'Vision 2047', establishing a clear, predictable, and efficient tax framework is crucial for sustainable growth. NITI Aayog's 'Consultative Group on Tax Policy' (CGTP) is dedicated to improving the ease of doing business, fostering FDI, streamlining tax legislation, and creating a system that is ready for the future.

Emphasizing a spirit of collaborative governance, the working paper was crafted through in-depth consultations with stakeholders, who contributed feedback on drafts before finalization.

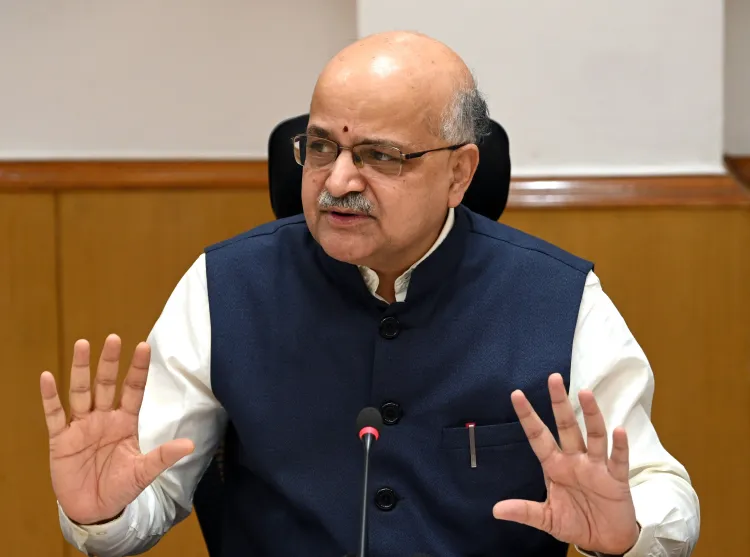

NITI Aayog CEO BVR Subrahmanyam remarked on India’s consistent rise in FDI and foreign portfolio investment (FPI) over the last two decades, showcasing robust economic fundamentals.

He pointed out that refining mechanisms related to Permanent Establishments will offer enhanced clarity and predictability in tax regulations, thus attracting new foreign investments and promoting the growth of existing multinational companies.

The launch event included representatives from CBDT, DPIIT, ICAI, and CBC, alongside industry experts from firms like Lakshmikumaran & Sridharan, Deloitte, and EY, highlighting the collaborative effort between public and private sectors in advancing tax policy reforms and nurturing a more predictable investment climate.

The working paper indicates that FDI and FPI are essential drivers of India’s economic advancement. A stable tax regime is vital for building trust among foreign investors.

Nonetheless, foreign investors often face substantial tax uncertainties and compliance challenges, particularly regarding issues tied to Permanent Establishment (PE) and profit attribution.

NITI Aayog notes that despite these tax challenges, India has experienced a significant rise in FDI inflows over the past twenty years, reinforcing its appeal as a prime investment hub.

This growth signals that India’s core economic strengths, including its vast market, demographic advantages, and ongoing reforms, are influential catalysts for attracting investment.

The working paper proposes a detailed framework aimed at improving tax certainty and predictability for foreign investors.

Recommendations include introducing an optional, industry-specific Presumptive Taxation Scheme for foreign firms, alongside enhanced legislative clarity, administrative efficiency, robust dispute resolution frameworks, and alignment with international best practices.