Did Muhammad Yunus Really Take Credit for the Microcredit Model?

Synopsis

Key Takeaways

- Muhammad Yunus faces allegations of hijacking a university research project.

- The microcredit model is claimed to have originated from Chittagong University.

- Aminul Hoque Polash, the whistleblower, is in exile due to alleged persecution.

- The revelations could reshape perceptions of Yunus's role in microfinance.

- Allegations hint at broader governance issues in Bangladesh.

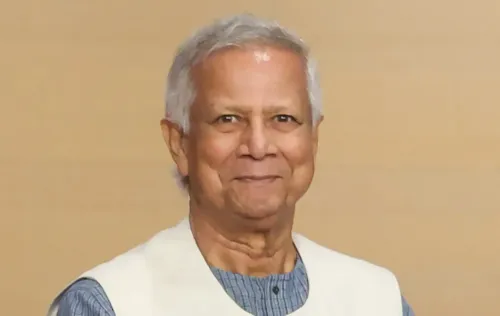

New Delhi, Nov 26 (NationPress) Muhammad Yunus, known as the architect behind Bangladesh’s Grameen Bank, is now facing scrutiny due to 'revelations' from long-standing documents uncovered by a former intelligence official. These documents allege that the microcredit model was initially a university research initiative that was later appropriated by the Nobel Laureate, presenting it as his own work.

Aminul Hoque Polash, the ex-Bangladeshi intelligence officer, claims to have discovered a collection of archival material dating from 1976 to 1983 that fundamentally questions Yunus's status as the founder of Grameen Bank, the institution that played a crucial role in earning him the Nobel Peace Prize in 2006.

Polash, who spent a decade in the National Security Intelligence (NSI) and later served as a diplomat, is currently in exile, claiming he was targeted for persecution by the Yunus administration.

The documents reportedly indicate that the microcredit model was spawned from a university research project developed by junior researchers, with Yunus allegedly taking credit for it later, supported by documents bearing his signature.

The Grameen Bank model, which provides small loans (micro-credit) to impoverished families without collateral, gained immense popularity and was adopted globally, even in certain cities in the US and Europe.

According to IANS, the microcredit initiative originated at Chittagong University, where Yunus was a faculty member.

“The Rural Economics Programme (REP) commenced in 1976 with a grant from the Ford Foundation, and the initial micro-lending trial in Jobra village was an action-research project executed by research scholars Shapan Adnan, Nasiruddin, and H.I. Latifee. Yunus was merely tasked with managing deep tubewell cooperatives,” the documents state.

Furthermore, it is claimed that the Bangladesh Bank adopted the microfinance model and planned a nationwide implementation prior to Yunus's involvement.

Another letter dated June 6, 1983, reveals the Ford Foundation's approval of grants to Chittagong University for supporting its rural finance initiative.

The microcredit model, which began as a university program in 1976, eventually transformed into a national scheme after receiving government authorization to operate as an independent bank.

Yunus later became its Project Director and, following the 1983 Grameen Bank Ordinance, took on the role of Managing Director. By the 1990s, he had gained complete control over the institution, which was reportedly developed with public funds.

The former intelligence officer continues to criticize the Yunus administration, asserting that Bangladesh is experiencing a resurgence of issues reminiscent of the 1970s.

Polash alleges that the individual who appropriated the renowned microfinance model is now attempting to seize control of state machinery after allegedly usurping power in 2024, manipulating it to eliminate barriers, reward supporters, and enrich his network.

“The same individual who misappropriated a rural research initiative now governs an entire nation, demonstrating an unrelenting desire for capture,” he asserts.

He cites numerous instances of misconduct, claiming that criminal sentences are being overturned, corruption cases dismissed, and undue financial advantages granted to Grameen enterprises.

He also holds the Yunus administration responsible for rampant nepotism, the issuance of licenses to his businesses, tax relief, and other privileges extended to Grameen Bank.

“The same individual who misappropriated a rural research initiative now governs an entire nation, driven by the same desire to capture,” he warns.