Are the Early Months of FY26 a Sign of a Resilient Economy?

Synopsis

Key Takeaways

- Strong economic indicators suggest resilience in FY26.

- Rural and urban demand are both on the rise.

- Inflation pressures are easing, contributing to positive consumer sentiment.

- Financial market stability has been observed despite external volatility.

- Labor market growth indicates a healthy job environment.

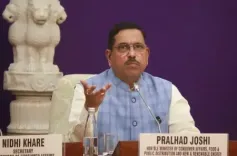

New Delhi, June 27 (NationPress) High-frequency indicators for the initial two months of FY26 showcase a robust performance of the domestic economy, even amidst a challenging geopolitical landscape, according to the Finance Ministry’s ‘Monthly Economic Review for May 2025’ released on Friday. The overall outlook for the Indian economy remains optimistic.

The economy displays remarkable resilience against a turbulent global backdrop, bolstered by strong domestic demand, declining inflationary pressures, a stable external sector, and a consistent employment scenario.

“The positive trend appears to be continuing into FY26, with initial high-frequency indicators (HFI) suggesting that economic activity has remained robust. Indicators like e-way bill generation, fuel consumption, and PMI indices reflect ongoing resilience,” the Economic Review stated.

Rural demand has further strengthened, aided by a fruitful rabi harvest and a favorable monsoon forecast. Urban consumption is buoyed by increased leisure and business travel, evidenced by rising air passenger traffic and hotel occupancy rates.

“Nevertheless, there are indications of a slowdown in sectors such as construction materials and vehicle sales. Retail and food price inflation saw a consistent and broad-based decline in May 2025, driven by strong agricultural output and effective government measures,” emphasized the Economic Review.

While domestic indicators remain generally positive, financial markets have experienced volatility due to external factors. The significant rise in trade tensions in early 2025, followed by a partial easing in the second quarter, has led to notable fluctuations in the financial markets.

However, the Indian government bond market showed stability and certainty in May, influenced by factors such as a record surplus dividend announced by the RBI and strong growth figures for Q4 FY25. Consequently, the risk premium on India’s government bonds decreased to 182 basis points as of May 30.

On the external front, India's total exports (including merchandise and services) recorded a year-on-year growth rate of 2.8 percent in May 2025, demonstrating the resilience of our exports amid tariff uncertainties and subdued global economic conditions, according to the Review.

As of June 13, foreign exchange reserves remain robust at $699 billion, providing an import cover of 11.5 months. Additionally, the Indian rupee has shown moderate volatility, compared to the more pronounced adjustments seen in other economies.

Indicators from the labor market reveal signs of stability. White-collar hiring has seen an increase, with core sectors such as AI/ML, Insurance, Real Estate, BPO/ITES, and Hospitality leading the hiring surge.

“The employment sub-indices of the PMI reflect significant employment growth, with these indices reaching a notable high. Formal job creation is also on the rise, as indicated by the increasing net payroll additions under the Employee Provident Fund Organisation,” noted the Review.

The steady economic performance in FY25 highlights the resilience of domestic growth drivers amidst a challenging global environment. Strong private consumption and a robust services sector were pivotal in driving overall economic expansion.

“The positive momentum has continued into the early months of FY26, as illustrated by the performance of high-frequency indicators such as e-way bill generation, fuel consumption, and PMI indices,” concluded the Economic Review.