How are India’s financial inclusion schemes connecting millions to the mainstream?

Synopsis

Key Takeaways

- Financial inclusion initiatives are reaching millions across India.

- Women are significantly represented in programs like PMJDY.

- UPI has transformed digital payments, accounting for 85% of transactions.

- Financial literacy is crucial for preventing digital fraud.

- Credit schemes target marginalized communities to support entrepreneurship.

New Delhi, Aug 11 (NationPress) The government’s financial inclusion initiatives—from Pradhan Mantri Jan Dhan Yojana (PMJDY) to MUDRA and the essential UPI-based digital payments—are transforming India’s narrative from a metropolitan focus to a truly national perspective, according to a recent report.

As stated by Prime Minister Narendra Modi, “Economic progress should not be confined to a select few cities and citizens. Development must encompass everyone and every region.”

“In reality, this inclusiveness is not just talk; it’s been propelled by carefully integrating policy, technology, and community outreach into a remarkable network of accessibility,” the report in India Narrative reveals.

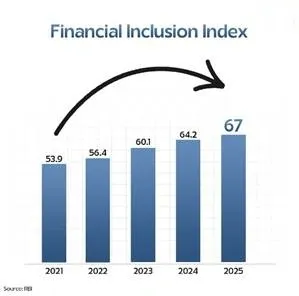

The Financial Inclusion Index, launched in 2021, is based on 97 indicators covering banking, insurance, pensions, investments, and postal services.

Its three sub-indices—Access, Usage, and Quality—evaluate not only the infrastructure's reach but also whether individuals actively utilize and comprehend financial products.

“The scale of implementation has been astonishing. The Pradhan Mantri Jan Dhan Yojana (PMJDY) alone has integrated 55.98 crore (560 million) people into the formal banking system, with over half being women. A network of 13.55 lakh (1.35 million) ‘Bank Mitras’—local banking representatives—now delivers services to remote villages,” the report notes.

Women predominantly hold Jan Dhan accounts, and the Atal Pension Yojana now features 48 percent female subscribers.

Furthermore, UPI accounts for 85 percent of all digital transactions in India and nearly half of global real-time digital payments.

Daily UPI transactions have surpassed 700 million for the first time, reaching 707 million as per the latest data from the National Payments Corporation of India (NPCI). This milestone was achieved on August 2. The number of daily transactions has doubled over the past two years, despite a slowdown in growth compared to earlier years.

However, as rural households increasingly adopt mobile banking, they also face a heightened risk of digital fraud. In response, the emphasis on financial education is shifting towards fraud prevention and grievance resolution.

Credit programs like MUDRA and Stand Up India specifically target SC, ST, and women entrepreneurs.

“The Mahila Sammriddhi Yojana equips women with craft skills and organizes them into self-help groups with access to credit. The Kisan Credit Card, now aiding over 7.7 crore farmers, minimizes reliance on informal moneylenders and enhances agricultural productivity,” the report states.

The World Bank’s Global Findex 2025 now indicates that account ownership in India stands at 89 percent—a significant increase from 35 percent in 2011.