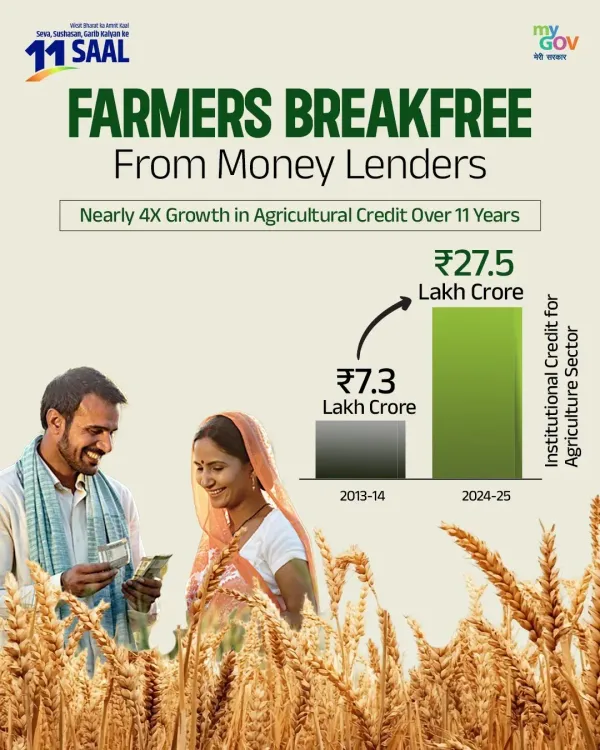

How did institutional credit to agriculture grow nearly 4 times to Rs 27.5 lakh cr in 11 years?

Synopsis

In a remarkable transformation, institutional credit for agriculture has skyrocketed under PM Modi's leadership, soaring from Rs 7.3 lakh crore to Rs 27.5 lakh crore. This incredible growth has empowered farmers across India, providing them with essential financial support and paving the way for greater stability and success in the agricultural sector.

Key Takeaways

- Institutional credit to agriculture has quadrupled in 11 years.

- Kisan Credit Card (KCC) scheme supports farmers with easy access to credit.

- Farmers can receive loans at 4 percent interest.

- Prompt repayment incentives reduce interest costs further.

- Government initiatives have transformed the agricultural landscape.

New Delhi, June 7 (NationPress) Over the past 11 years, during the tenure of Prime Minister Narendra Modi, institutional credit for agriculture has dramatically increased from Rs 7.3 lakh crore to Rs 27.5 lakh crore, as reported by the Ministry of Finance on Saturday.

Under PM Modi’s leadership, a farmer-centric approach has resulted in a remarkable rise in support prices, prompt credit, and unprecedented payouts—ensuring security and stability for all cultivators, as highlighted by the minister in a post on the X social media platform.

“PM Modi has made certain that no ‘annadata’ is left waiting for timely financial assistance, with institutional credit for agriculture nearly quadrupling—from Rs 7.3 lakh crore in 2013-14 to Rs 27.5 lakh crore in 2024-25,” the ministry further elaborated.

From marginal lands to international markets, Indian farmers are thriving like never before.

Since 2014, under PM Modi’s guidance, “our ‘annadatas’ have received dignity, income support, assurance of MSP, agricultural infrastructure, and access to global markets,” according to government statements.

The Kisan Credit Card (KCC) initiative has proven to be a vital resource for millions of farmers.

KCC is a financial product designed to offer farmers timely and affordable credit for procuring agricultural inputs such as seeds, fertilizers, and pesticides, as well as for fulfilling cash needs related to crop production and allied activities.

“More than 465 lakh applications have been approved with a credit limit of Rs 5.7 lakh crore,” stated Finance Minister Nirmala Sitharaman.

The initiative has facilitated “easy access to short-term crop loans.” Approximately Rs 5.7 lakh crore has also been approved in credit, with “interest rates as low as 4 percent with timely repayment.”

Through the KCC scheme, farmers can secure a loan of up to Rs 3 lakh at just 4 percent interest, provided they repay on time.

An additional Prompt Repayment Incentive of 3 percent is being offered to farmers for timely loan repayment, effectively lowering the interest rate to 4 percent for them. Thus, for every one lakh KCC loan, farmers can save up to Rs 9,000 in annual interest.