How Did Modi's Insurance Scheme Become a Lifesaver for a Daughter After Her Mother's Passing?

Synopsis

Key Takeaways

- Life insurance can provide crucial financial support.

- Small premiums can lead to significant payouts.

- Government schemes can make a real difference in families' lives.

- Awareness of such programs is essential for financial planning.

- Community support can enhance the benefits of these initiatives.

Bihar Sharif (Bihar), June 27 (NationPress) A mother may be gone, but her foresight has illuminated the future for her daughter.

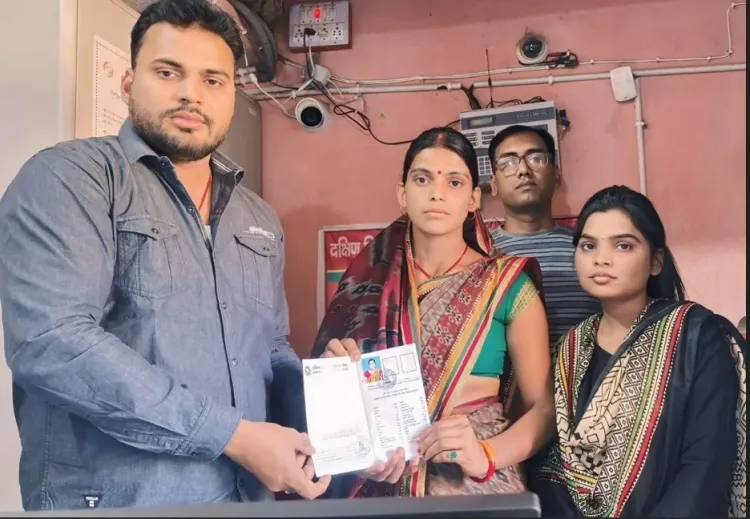

In the village of Bhat Bigha in Bihar Sharif, Nisha Kumari received a life-altering sum of Rs 2 lakh, courtesy of a modest insurance premium of merely Rs 436 that her deceased mother had paid under the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) – a government-backed life insurance initiative.

While standing at the Takia Kalan branch of Dakshin Bihar Gramin Bank, Nisha held the cheque with a mix of sorrow and gratitude in her eyes.

"Maa to chali gayi, lekin sarkar ki iss yojana ne humein akela hone se bacha liya" (Though my mother is no longer with us, this scheme has rescued us from despair)," she expressed, her voice filled with emotion.

Her mother, Sheela Devi, passed away on January 5 this year.

Prior to her passing, she had quietly enrolled in the PMJJBY scheme, paying the small annual premium through her bank account.

Neither she nor her daughter could have anticipated how vital that simple action would prove.

A small premium, a significant impact

Following her mother’s death, Nisha visited the bank with Sheela Devi’s documents. To her astonishment, the bank informed her about the insurance policy.

"The staff guided me through the process, and in just a few days, the amount was credited to my account," Nisha noted.

She added that her mother had taken a Rs 35,000 loan from a local self-help group.

"This financial support will help me repay that loan and provide a better education for my children. I am immensely grateful that this scheme exists," she stated, with hands folded, "We thank Prime Minister Modi for initiating this scheme. It truly assists families like ours during tough times."

What is PMJJBY and who can apply?

Branch Manager Ashish Ranjan, who handed over the cheque, explained that the Pradhan Mantri Jeevan Jyoti Bima Yojana is available to any Indian citizen aged between 18 and 50 years with a bank account. For a nominal annual premium of Rs 436, it provides Rs 2 lakh to the nominee in the event of the insured individual’s death – regardless of the cause.

"It’s a straightforward yet powerful scheme," Ranjan said.

"All it requires is a filled application form and an active bank account. Once the claim is submitted, the funds are typically transferred within four to five days."

He also mentioned that the Takia Kalan branch has already distributed similar benefits to two families in this financial year.

A lasting gift of security

For Nisha Kumari, the insurance funds represent more than just financial aid – they are a reminder of her mother’s love, even in her absence.

"I hope no one ever endures what I have experienced," she concluded, "but if they do, may they have the backing of a scheme like this."