Why Did Indian Stock Markets End the Week Lower Amid Trade Deal Concerns?

Synopsis

Key Takeaways

- Indian equity markets faced declines amid trade deal jitters.

- Profit booking was evident after recent gains.

- Both Nifty and Sensex slipped 0.7% over the week.

- Defensive sectors like IT and healthcare showed positive performance.

- Key technical levels indicate potential market consolidation.

Mumbai, July 5 (NationPress) The Indian equity markets concluded the week on a down note as investors grew wary in anticipation of the pivotal July 9 US-India trade deadline and the onset of the corporate earnings season, analysts indicated on Saturday.

Both primary indices — the Sensex and the Nifty — declined by 0.7% each over the week, as broader market sentiment remained overshadowed by global unpredictability and profit-taking following a recent surge.

The Nifty wrapped up the week at 25,461, while the Sensex finished at 83,432.89. The indices had kicked off the week with a robust breakout, but that momentum waned amid worries of a potential delay in finalizing trade agreements.

Nevertheless, reports hinting at a possible interim deal between India and the US helped mitigate losses in the week’s latter half.

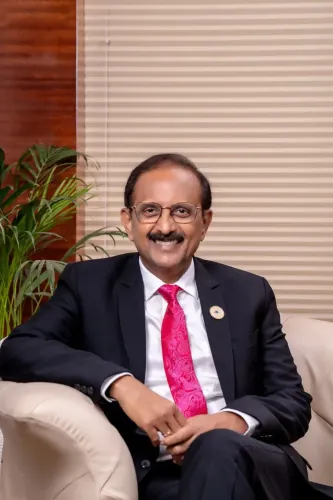

Ajit Mishra from Religare Broking Limited noted that the pullback was predominantly driven by profit booking from investors after recent gains.

“The cautious sentiment was apparent with the impending trade deadline. However, optimism surrounding a possible agreement between India and the US provided a cushion,” he remarked.

India's fiscal state remains robust, bolstered by a strong Rs 2.69 lakh crore dividend transfer from the RBI, which has helped keep the fiscal deficit at just 0.8% of the annual target.

June GST collections also stayed strong, climbing 6.2% year-on-year (YoY) to Rs 1.84 lakh crore.

Vinod Nair, Head of Research at Geojit Financial Services, stated, “The week witnessed some consolidation after significant gains in preceding sessions. Global cues remained mixed, and investors chose to remain cautious ahead of the US tariff decision.”

“FIIs turned wary due to high valuations, but support from DIIs prevented the market from experiencing a sharp decline,” Nair added.

From a sectoral standpoint, defensive sectors such as IT and healthcare performed well, buoyed by stock-specific movements and steady demand.

Conversely, rate-sensitive sectors like banking, auto, and realty faced pressure due to profit booking.

FMCG stocks also fell slightly. However, defense stocks saw robust buying after the government approved several high-value contracts.

Technically, the market entered a phase of consolidation. Bajaj Broking Research observed that the Nifty formed a small bear candle with higher highs and lows on the weekly chart, indicating consolidation amid stock-specific actions after the recent strong upward trajectory.

“Key support levels are identified around 25,150–25,200, aligning with the 20-day exponential moving average, while resistance is anticipated near the 25,600–25,740 zone,” according to Angel One.

“A breakout above this range could ignite the next phase of the rally,” the brokerage concluded.