Will the RBI Maintain the Policy Rate at 5.50% During the MPC Meeting?

Synopsis

Key Takeaways

- The RBI is expected to maintain the repo rate at 5.50 percent.

- Analysts believe a surprise rate cut is possible.

- The MPC meeting is from September 29 to October 1.

- GST reforms are positively influencing demand and inflation.

- Inflation forecasts remain low, potentially hitting historical lows.

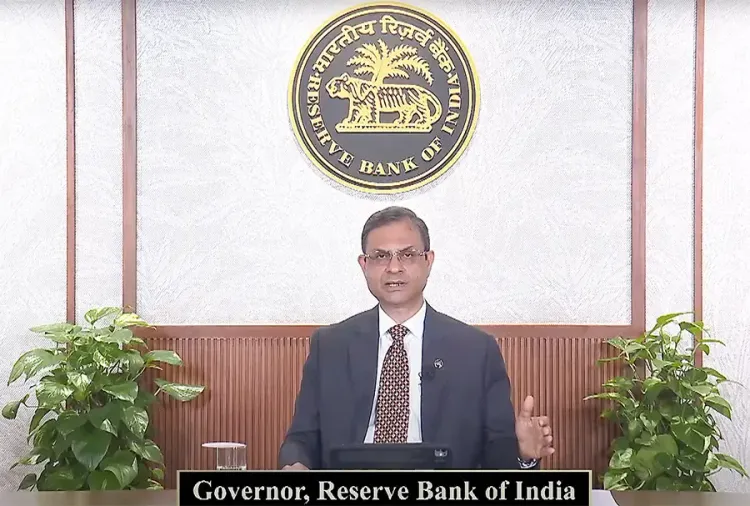

Mumbai, Sep 29 (NationPress) The upcoming three-day Monetary Policy Committee (MPC) meeting of the Reserve Bank of India, which kicks off on Monday, is anticipated to maintain the key policy rate at 5.50 percent.

However, analysts caution that a surprise rate cut cannot be dismissed given the backdrop of US trade tariffs and low inflation.

Since the start of this year, the RBI has already reduced rates by 100 basis points.

The MPC session is set for September 29 to October 1, during which the central bank will evaluate interest rates. The current repo rate is fixed at 5.5 percent.

In the previous review, the RBI opted to keep the policy rate steady, but since February 2025, it has decreased the repo rate by nearly one percentage point.

Experts speculate that the Central Bank will likely maintain the current repo rate, given the favorable outcomes from GST reforms affecting demand, stronger-than-expected Q1 FY26 GDP growth, and an anticipated upward trend in the inflation trajectory.

The inflation forecast has remained subdued due to GST rationalisation, which, according to ICRA, has averaged around 2.6 percent for FY2026.

While GST rationalisation is expected to curb inflation, it is a result of policy shifts that will likely lead to increased demand.

This indicates a likelihood of maintaining the repo rate during the upcoming October 2025 review, a view echoed by Aditi Nayar, Chief Economist at ICRA.

Nevertheless, with inflation potentially hitting a historic low since 2004 due to GST rationalisation and ongoing India-US trade negotiations, a rate cut in September could be the most prudent move for the RBI, positioning it as a forward-looking institution, according to a report from SBI.

In its August meeting, the RBI kept the policy rate steady at 5.50 percent, following substantial easing in the prior session.

Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor at SBI, stated, “We believe that the bottom of CPI inflation may not yet have been reached, and it could further decline by 65-75 bps due to the extensive GST rationalisation.”

“Inflation is expected to remain manageable even in FY27, and without a GST cut, it is projected to be below 2 percent in September and October. CPI figures for FY27 are currently tracking at 4 percent or less, and the October CPI could be as low as 1.1 percent — the lowest since 2004,” Ghosh noted.