Should the RBI Exclude Small Borrowers from New Gold Loan Norms?

Synopsis

Key Takeaways

- The Finance Ministry recommends excluding borrowers up to Rs 2 lakh from new RBI gold loan norms.

- Implementation of these guidelines may be delayed until January 1, 2026.

- The DFS has emphasized the importance of time for effective rollout.

- Shares of Muthoot Finance and Manappuram rose following the Finance Ministry's feedback.

- RBI is expected to consider public feedback before finalizing the guidelines.

In a recent statement from New Delhi, on May 30 (NationPress), the Finance Ministry has recommended that the Reserve Bank of India (RBI) consider exempting small borrowers with loans up to Rs 2 lakh from its draft guidelines regarding lending against gold collateral. Furthermore, the Ministry has proposed that the enforcement of these guidelines be delayed until next year.

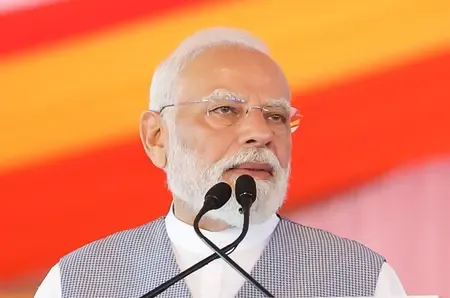

According to the Finance Ministry, the Department of Financial Services (DFS), under the leadership of Finance Minister Nirmala Sitharaman, has evaluated the draft directives for lending against gold collateral. The DFS has advised the RBI to take into account the needs of small gold loan borrowers to prevent any negative impact on them.

Additionally, the DFS has mentioned that these guidelines require adequate time for implementation in the field, suggesting a possible rollout starting from January 1, 2026. The statement clarified that excluding borrowers below Rs 2 lakh from the proposed requirements would facilitate quick and efficient loan disbursement for these smaller amounts.

“The RBI is currently reviewing the feedback on the draft guidelines. It is anticipated that the concerns expressed by various stakeholders, along with public feedback, will be thoroughly considered by the RBI prior to finalizing the directives,” the statement noted.

In response to the Finance Ministry's remarks, shares of Muthoot Finance and Manappuram saw an uptick, trading at Rs 2,136.10 and Rs 233.14 respectively, marking increases of 3.07% and 0.57%.

Previously in April, the RBI had released draft guidelines aimed at establishing consistent rules for obtaining gold loans from banks and non-banking financial companies (NBFCs).

However, the proposed rules introduced certain limitations on the types of gold eligible as collateral and the maximum loan amounts banks or NBFCs can provide.

The RBI identified issues such as inadequate loan appraisal processes, insufficient monitoring of fund usage, and a lack of transparency during gold auctions post-default. The current draft guidelines aim to standardize norms across different lenders while considering their individual risk-bearing capabilities.