Has the GST Council Just Revolutionized the Tax Structure?

Synopsis

Key Takeaways

- The GST Council has reduced tax slabs from four to two.

- 5% and 18% are the new GST rates.

- Personal care items see a tax decrease to 5%.

- Tobacco products face a significant tax increase.

- Reforms are designed to benefit all sections of society.

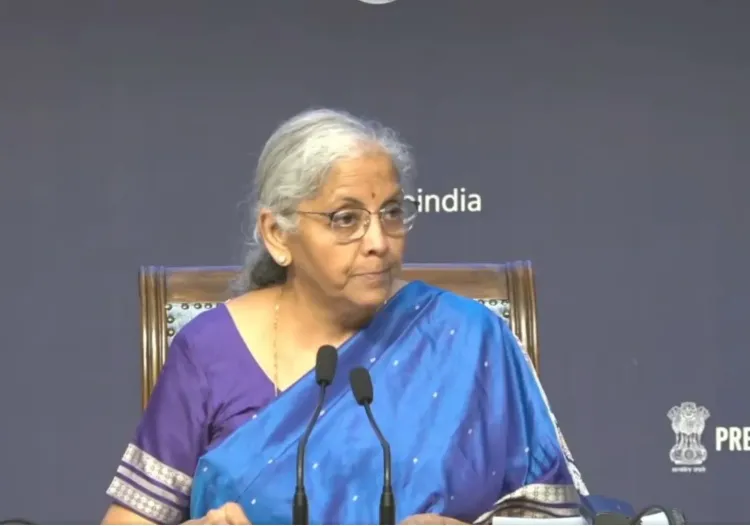

New Delhi, Sep 3 (NationPress) In a major development, the GST Council, under the leadership of Finance Minister Nirmala Sitharaman, has revamped the indirect tax framework by reducing the current four tax slabs to just two. The previous rates of 12 per cent and 28 per cent have been eliminated, while the 5 per cent and 18 per cent rates are retained.

This new GST structure will come into effect starting September 22.

The council has decreased the tax on personal care products such as hair oil, shampoo, toothpaste, and dental floss from 18 per cent to 5 per cent.

On the other hand, the tax on tobacco products, including cigars, cheroots, cigarillos, and cigarettes, has been raised significantly from 28 per cent to 40 per cent.

Additionally, the GST Council has lowered the tax rate on popular snacks like namkeens, bhujia, mixtures, chabena, and other ready-to-eat packaged foods from 12 per cent to 5 per cent, making them more accessible to consumers.

Conversely, the tax rate on all items containing added sugar, sweeteners, or flavors, including aerated drinks, will see an increase from 28 per cent to a steep 40 per cent.

Prime Minister Narendra Modi, in his Independence Day address, indicated that the Central government intends to implement significant reforms in GST, focusing on three pillars: structural reforms, rate rationalization, and improving the quality of life.

The areas earmarked for next-generation reforms include tax rate rationalizations aimed at benefiting all segments of society, particularly the common man, women, students, the middle class, and farmers.

These reforms are expected to minimize disputes related to classification, rectify inverted duty structures in specific sectors, ensure greater stability in rates, and enhance the overall ease of doing business.

According to PM Modi, these GST reforms will fortify key economic sectors, ignite economic activity, and facilitate sectoral growth.