How Are GST Reforms Paving the Way for Atmanirbhar Bharat?

Synopsis

Key Takeaways

- GST Rates Simplified: Only two rates now - 5% and 18%.

- Lower Prices: Essential goods become cheaper, boosting savings.

- Support for Farmers: Reduced GST on agricultural tools and inputs.

- Economic Growth: Eased tax burden supports businesses and consumers.

- Transparent System: Simplification leads to fewer disputes and clearer regulations.

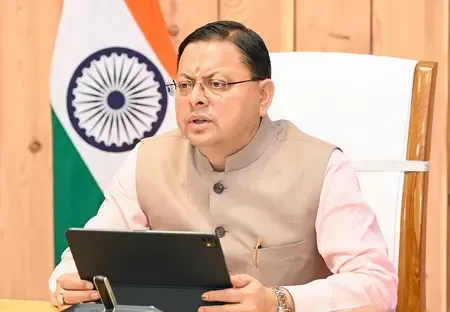

Chandigarh, Sep 6 (NationPress) Haryana's Chief Minister Nayab Singh Saini proclaimed on Saturday that the Goods and Services Tax (GST) reforms unveiled by Prime Minister Narendra Modi during Independence Day celebrations from the Red Fort have been successfully executed within a month.

Referring to this development as a manifestation of Modi's unwavering commitment, Saini emphasized that these reforms mark a significant step towards establishing an Atmanirbhar Bharat.

In a media briefing, he stated that these modifications will play a crucial role in fulfilling the Prime Minister's vision for swadeshi and the Make in India initiative.

During the 56th GST Council meeting on September 3, numerous pivotal decisions were taken aimed at lightening the load on citizens, aiding businesses, and bolstering the economy.

Describing the decisions as commendable measures, he noted that the rationalization of GST rates would lead to lower prices on essential consumer goods, thereby enhancing middle-class savings and stimulating demand in the approaching festive season.

The Chief Minister asserted that the GST has streamlined and increased transparency in the taxation system. It has also dismantled trade barriers between states, aligning with Prime Minister Modi's vision of ‘One Nation, One Tax, One Market’.

According to him, India will now operate with just two standard GST rates: 5 percent and 18 percent, scrapping the previous 12 percent and 28 percent slabs, while maintaining a special 40 percent rate for 'demerit' goods.

This simplified classification is expected to minimize disputes and litigation, while lowering GST rates on frequently used goods and abolishing the cess, directly reducing household expenses. The inverted duty structure on textiles and fertilizers has also been eliminated, alleviating working capital constraints for dealers.

The registration process has been made easier, allowing for automatic registration within three days for low-risk applicants, with system-based provisional refunds to be issued within established timelines.

Highlighting that the reforms primarily consider farmers' interests, the Chief Minister noted that Haryana, an agrarian state, had requested the Council to lower GST rates on agricultural equipment for crop residue management, and this request was granted. He expressed his gratitude to Union Finance Minister Nirmala Sitharaman for her support.

Packaged milk and cheese are now free from GST, while rates on ghee, butter, and dry fruits have been reduced from 12 percent to 5 percent. Roti and paratha have been completely exempted.

These initiatives, he stated, will not only curb inflation but also foster traditional food businesses, enhance food processing in Haryana, increase farmers' value addition, and generate rural employment.

The GST Council has also reduced GST on irrigation and tillage machinery from 12 percent to 5 percent, cutting equipment costs. Inputs like bio-pesticides and fertilizers, including ammonia, sulphuric acid, and nitric acid, will only incur 5 percent GST, promoting sustainable agriculture.

Moreover, the GST rate for tractors has been lowered from 12 percent to 5 percent for engines under 1800 cc, and from 28 percent to 18 percent for higher-capacity tractors.

CM Saini stated that this progressive move will motivate farmers to embrace modern machinery and expedite farm mechanization.