How Does the Pradhan Mantri Jeevan Jyoti Bima Yojana Support Deprived Communities?

Synopsis

Key Takeaways

- Affordable Coverage: The scheme offers life insurance at a low premium of Rs 436.

- Financial Security: Beneficiaries receive Rs 2 lakh in case of an unforeseen event.

- Wide Reach: The scheme reaches nearly every village in Jharkhand.

- Support for Families: It provides essential financial support to families in need.

- Government Commitment: The initiative reflects the government's dedication to uplifting marginalized communities.

Ranchi, June 17 (NationPress) The Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) has significantly transformed the lives of marginalized communities across India. Initiated on May 9, 2015, this insurance program offers access to affordable life insurance for low-income groups at minimal premiums. In the event of an unforeseen incident, an insurance cover of Rs 2 lakh is provided for an annual premium of just Rs 436.

This initiative has particularly benefited the tribal regions of Latehar district in Jharkhand, where numerous participants have enrolled in the PMJJBY scheme, reaping its rewards.

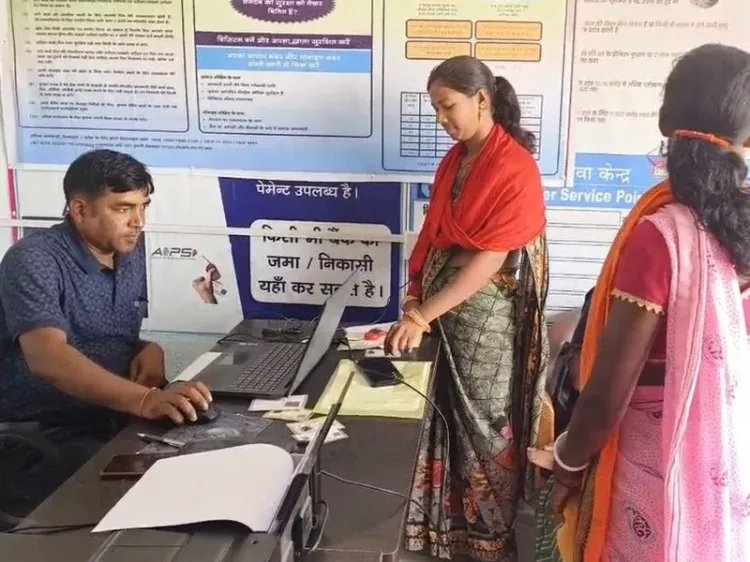

Through the efforts of Bank Mitras and local committees, the scheme has made its way into nearly every village. Locals expressed their gratitude to IANS, highlighting the remarkable changes the scheme has introduced in their lives.

Pramila Devi from Balumath block shared with IANS, “My husband and I enrolled in the Jeevan Jyoti insurance scheme. The premium was Rs 436. After my husband passed away a year later, life became incredibly challenging for me and my children. The Rs 2 lakh I received under the scheme eased our financial burden. We are grateful to Prime Minister Narendra Modi for this support.”

Soni Devi, a member of the Balumath Sakhi Mandal, stated, “The Pradhan Mantri Jeevan Jyoti Bima Yojana is not only ensuring security for the underprivileged but also reinforcing their belief that the government stands by them.”

Rajiv Kumar Mandilwara, the District Manager of Latehar, reported that 119,488 individuals have signed up for PMJJBY, with coverage extending to those aged between 18 and 50.

“The insurance coverage runs annually from June 1 to May 31. The premium remains at Rs 436. If a participant passes away between the ages of 18 and 50, their family receives financial assistance,” he explained.