Is the Major GST Reform Set to Benefit All Sections of Society?

Synopsis

Key Takeaways

- GST 2.0 reforms simplify the tax structure.

- All segments of society are expected to benefit.

- New rates are 5%, 18%, and 40% on luxury goods.

- Prices of daily-use items will decrease.

- Government plans to analyze the impact on GDP and revenue.

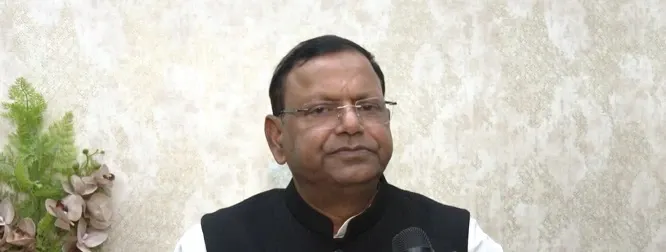

New Delhi, Sep 4 (NationPress) Union Minister of State for Finance, Pankaj Chaudhary, praised the GST 2.0 reforms on Thursday, describing them as a "significant transformation" that is expected to influence every group within Indian society.

In an exclusive interview with IANS, Pankaj Chaudhary stated: "A substantial reform has taken place. It will affect all sections of society — from the underprivileged, middle class, and farmers across all regions, to sectors like education and healthcare. Everyone is set to gain in one way or another."

The newly designed GST framework, which reduces the existing four-rate system to two, aims to simplify compliance and alleviate confusion, particularly for small traders and businesses.

“Previously, the multiple GST slabs caused confusion for small traders. By consolidating it to two rates, we are ensuring a more effective and streamlined system,” he added.

Chaudhary also discussed particular tax elements, including the contentious taxation on luxury items and sin products.

“There is a belief that taxes on products like cigarettes and alcohol should be lowered, and there have been proposals to reclassify them. However, a 40 percent tax on luxury vehicles isn't burdensome for those buying them — which is why it remains unchanged.”

He also mentioned that a comprehensive evaluation of the reform's effects on GDP and revenue will take place in the upcoming months.

"We will assess the GST collections after implementation — starting from September 22. A clearer picture will emerge within a month or two," he noted.

In response to criticism from the Opposition, particularly the Congress party, Chaudhary rejected claims that the reforms were a reaction to political pressures.

"We were already reaping significant benefits from GST. Prime Minister (Narendra) Modi aimed to ensure these advantages reached the common populace. That’s the reason these reforms were initiated — not due to any political influence," he asserted.

As the GST Council sanctioned unprecedented modifications to India's indirect tax framework, numerous everyday goods are set to become more affordable starting September 22.

The newly adopted tax structure, approved on Wednesday, now features two main slabs of 5 percent and 18 percent, with a notable 40 percent applicable to luxury and sin goods.

For the average citizen, this adjustment signifies more disposable income, which the government hopes will stimulate the economy, providing it with a substantial uplift.

From groceries and fertilizers to footwear, textiles, and even renewable energy, a wide array of goods and services is poised to become less expensive. Items that were once taxed at 12 percent and 28 percent will largely transition to the other two slabs, making a vast range of products cheaper.