Is the Government Really Simplifying the GST Structure?

Synopsis

Key Takeaways

- Political tensions are rising over GST reforms between Congress and BJP.

- Mani Shankar Aiyar accuses the government of neglecting small traders.

- The BJP claims GST has resulted in significant savings for the public.

- Calls for reforms to include tobacco, electricity, and alcohol in GST.

- Upcoming festive season may see lower prices due to GST adjustments.

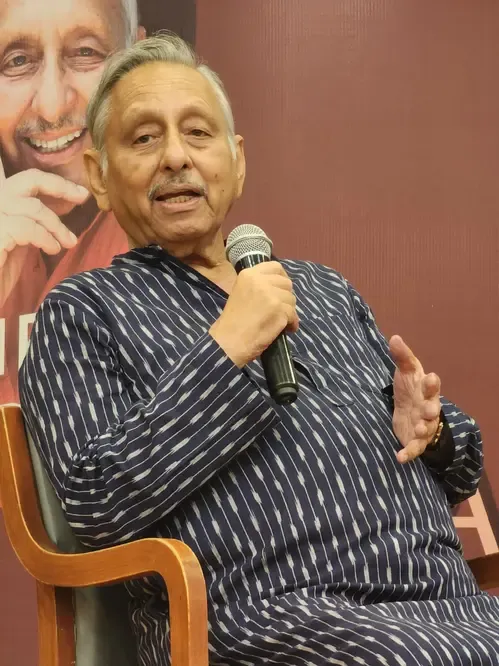

New Delhi, Sep 23 (NationPress) A new political controversy has emerged regarding the Goods and Services Tax (GST) reforms, as senior Congress figure Mani Shankar Aiyar has accused the Central government of neglecting critical reform suggestions and adversely affecting small traders. In response, BJP leaders assert that the GST has delivered extensive relief and savings for the populace.

Aiyar criticized the government's recent assertions about simplifying the GST framework, stating: “Today, Modi ji and his followers claim to have simplified GST. If they had heeded our advice, this could have been achieved a decade ago. We proposed an 18 percent cap from the beginning. Over the last ten years, small traders and consumers have faced significant difficulties, with thousands of crores taken from them. Now they claim to be bestowing a gift this Dussehra with the 18 percent ceiling. Why wasn’t this implemented earlier?”

He also called on the government to incorporate tobacco, electricity, and alcohol under GST within the next five years.

“You can levy any tax within GST, but there must not be a disparity between states, with some taxed at 10 percent and others at 50 percent. This is entirely unjust,” Aiyar asserted.

In defense, Union Minister Giriraj Singh supported the GST system and challenged Congress' legacy during its governance.

“When Congress was in control, the Income Tax exemption threshold was set at Rs 3 lakh. Modi ji raised it to Rs 12 lakh. You may disagree, but ask the youth, the elderly, the farmers, and every household is currently reaping the benefits. The GST rates on food items have also been reduced,” he remarked.

Referring to the festive season, Singh mentioned: “With lowered GST rates, festivals like Durga Puja, Diwali, and Chhath will be more affordable. Congress leaders should vow to purchase only 'Made in India' products.”

BJP leader Syed Shahnawaz Hussain also dismissed Congress' allegations as unfounded.

“Significant changes have been made in GST. People are saving substantially. From food to vehicles, everything is now cheaper — including cycles, motorcycles, TVs, and fridges. Yet, Congress leaders continue to make trivial statements. Why didn’t they enact these reforms while in power?” he questioned.

This verbal tussle arises as the government pushes for recent updates aimed at simplifying the GST system, with the goal of easing compliance and standardizing rates. While Congress contends that these actions are inadequate and late, BJP maintains that the Modi government has offered substantial economic relief to all segments of society.