What Are the Key Triggers for India-Pak Tensions and Economic Data Next Week?

Synopsis

Key Takeaways

- Retail Inflation: CPI data release on May 13 is crucial.

- Quarterly Results: Numerous companies releasing earnings.

- US Economic Data: CPI MoM and YoY figures to be monitored.

- Geopolitical Tensions: India-Pakistan relations impacting markets.

- Sector Performance: Real estate and PSU banks lagging behind.

Mumbai, May 11 (NationPress) The outlook for the Indian stock market in the upcoming week will be influenced by a host of domestic and international factors, including retail inflation, quarterly earnings, and US jobless claims data, among others.

Notably, several companies such as SMC Global, Bajaj Electricals, JM Financial, Raymond, Tata Steel, UPL, AB Capital, Bharti Airtel, Cipla, Hero MotoCorp, Tata Motors, HAL, Tata Power, and JSW Energy are set to announce their Q4 FY2024-25 results next week.

In India, attention will be drawn to inflation with the upcoming release of CPI YoY data on May 13, which will provide insights into consumer price trends and their potential impact on the Reserve Bank of India's monetary policy. Furthermore, the Exports YoY data on May 15 will offer a glimpse into the status of India’s external trade amidst global uncertainties.

In the United States, inflation and consumption data will be in focus. On May 13, both CPI MoM (Month-on-Month) and YoY (Year-on-Year) figures will be keenly observed for hints regarding the direction of the Federal Reserve’s policies.

Meanwhile, on May 15, China will publish its Money Supply M2 YoY data, a vital indicator of liquidity and credit growth that may shape expectations for monetary easing.

Bajaj Broking Research noted, "The period from May 13 to 16, 2025, will see significant economic data releases across India, the US, and China, likely influencing investor sentiment and central bank expectations."

Last week, the stock market experienced a downturn, largely driven by escalating tensions between India and Pakistan.

The Sensex fell by nearly 1,047 points, concluding at 79,454, while the Nifty decreased by 338 points to finish at 24,008, both reflecting a weekly loss of around 1.4 percent.

Sector-wise, real estate and PSU banks were the biggest losers, declining approximately 6.5 percent and 4.5 percent, respectively, while the auto and media sectors defied the trend to post gains.

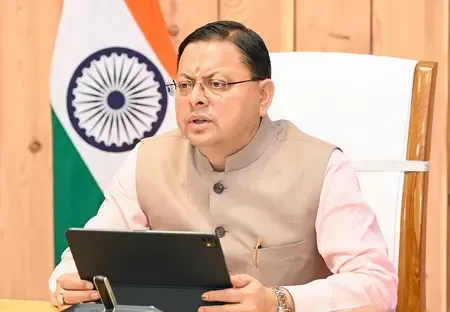

Puneet Singhania, Director of Master Trust Group, stated, "The escalating tensions between India and Pakistan are likely to shape investor sentiment in the forthcoming week, resulting in a cautious atmosphere in Indian equity markets. Any intensification along the border or significant diplomatic developments could lead to increased uncertainty."

"In addition to geopolitical concerns, the ongoing Q4 corporate earnings season will continue to drive stock-specific movements. Further developments on both geopolitical and corporate fronts will be crucial in determining market direction," he added.