How Did NPAs of Public Sector Banks Drop from 9.1% to 2.58%?

Synopsis

Key Takeaways

- NPAs reduced from 9.11% to 2.58%.

- Government and RBI measures are effective.

- Insolvency and Bankruptcy Code (IBC) changed recovery dynamics.

- Enhanced valuation procedures ensure transparency.

- Debt Recovery Tribunals focus on high-value cases.

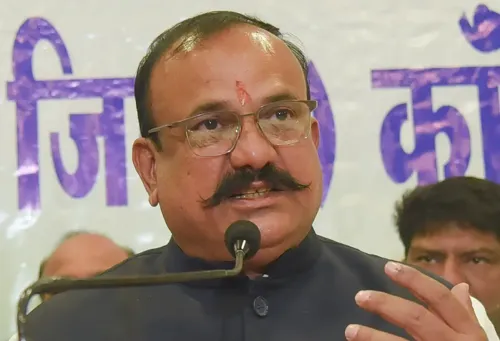

New Delhi, July 22 (NationPress) The gross non-performing assets (NPAs) of public sector banks have experienced a significant decrease, falling from 9.11% of total loans in March 2021 to 2.58% in March 2025, as reported by Pankaj Chaudhary, Minister of State in the Ministry of Finance, during a parliamentary session on Tuesday.

The total amount tied up in gross NPAs of public sector banks has reduced from Rs 6,16,616 crore in March 2021 to Rs 2,83,650 crore in March 2025, according to the minister's written reply to a question in the Rajya Sabha.

To tackle the issue of NPAs, the Government and the Reserve Bank of India (RBI) have implemented comprehensive measures. This includes a transformation in the credit culture, significantly influenced by the Insolvency and Bankruptcy Code (IBC), which has altered the dynamics between creditors and borrowers by limiting the control of defaulting companies' promoters/owners and disallowing willful defaulters from participating in the resolution process. Additionally, personal guarantors to corporate debtors have also been incorporated under the IBC's jurisdiction, the minister added.

Amendments to the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and the Recovery of Debt and Bankruptcy Act have been made to enhance their effectiveness in recovering bad loans.

Moreover, the pecuniary jurisdiction of Debt Recovery Tribunals (DRTs) has been raised from Rs 10 lakhs to Rs 20 lakhs to enable the DRTs to concentrate on high-value cases, which has resulted in improved recovery for banks and financial institutions, the minister further stated.

Public sector banks have also established specialized stressed assets management divisions and branches to effectively monitor and follow up on NPA accounts, facilitating faster and more efficient recoveries.

The introduction of business correspondents and the adoption of a 'feet-on-street' model have also contributed positively to the recovery trajectory of NPAs in banks, the minister remarked.

Furthermore, the RBI has issued a prudential framework for resolving stressed assets to provide a structure for early recognition, reporting, and timely resolution, including incentives for lenders to adopt resolution plans swiftly, which has aided in recovering bad loans.

In compliance with RBI guidelines, banks are required to have a board-approved policy for property valuation conducted by qualified independent valuers. The RBI mandates that banks follow a procedure for the empanelment of professional valuers based on minimum qualifications and maintain an approved list of valuers.

Valuation of fixed assets is carried out before loan approval as part of the appraisal process and prior to sales for recovering dues under the SARFAESI Act, 2002, the minister explained.

To ensure transparency, for properties valued at Rs 50 crore or above, banks obtain at least two independent valuation reports. When enforcing security interest on an NPA account, the bank takes possession of the property and secures a valuation from an approved valuer before its disposal.

According to the RBI's guidelines on the sale of stressed assets by banks, the use of e-auction is encouraged as a preferred method for selling properties, which attracts a diverse range of bidders and facilitates better price discovery, the minister concluded.