Is a Former UCO Bank Official Linked to a Bank Loan Forgery Case?

Synopsis

Key Takeaways

- Subodh Kumar Goel arrested for alleged bank loan forgery.

- Involvement of Concast Group in misappropriating funds.

- ED's crackdown on financial misconduct continues.

- Provisional asset attachments demonstrate serious implications.

- Overall fraud estimated at Rs 6,000 crore.

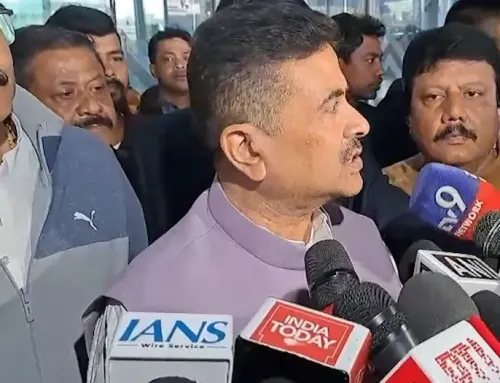

Kolkata, May 17 (NationPress) The Enforcement Directorate (ED) has apprehended Subodh Kumar Goel, the ex-chairman and managing director of UCO Bank, a prominent public sector bank based in Kolkata, in relation to a substantial bank loan forgery case involving the chairman and managing director of Concast Group, as reported on Saturday.

Goel was taken into custody in New Delhi on Friday, subsequently brought to Kolkata under transit remand on Saturday, and presented before a special court.

The allegations against Concast Steel suggest that the company borrowed approximately Rs 1,400 crore from UCO Bank but misappropriated these funds by diverting them to various shell companies rather than using them for their intended purposes.

Goel is implicated in this scheme, as the authorities from Concast Steel reportedly colluded with him to orchestrate this forgery. The ED claims that Goel personally benefited financially from this fraudulent activity.

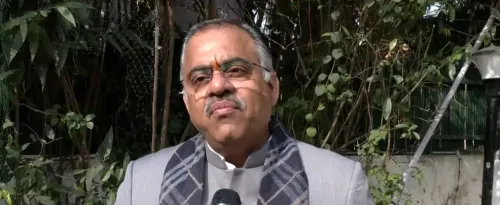

In February this year, the ED announced the provisional attachment of real estate worth Rs 210.07 crore linked to Sanjay Kumar Sureka, the chairman and managing director of Concast Group, on January 31, 2025.

Previously, in December of the prior year, ED officials, accompanied by central armed forces personnel (CAPF), executed an extensive raid at Sureka's residence in Ballygunge, South Kolkata, in connection with the forgery investigation.

During the raid, authorities seized Rs 2 crore in cash, Rs 4.5 crore in jewelry, and two luxury vehicles. Sureka was also arrested during this operation.

According to the ED, the total amount involved in the bank loan forgery, including that with UCO Bank, is estimated to be around Rs 6,000 crore. Sureka faces accusations of utilizing bank accounts registered under employees' and business associates' names to secure these loans.