Have 7,253 Claims Been Received Under the Unified Pension Scheme?

Synopsis

Key Takeaways

- 7,253 claims received under UPS.

- 4,978 claims processed for benefits.

- Eligible Central government employees include those with 10+ years of service.

- Tax benefits available under Income Tax Act, 1961.

- Cutoff date for opting into UPS extended to September 30, 2025.

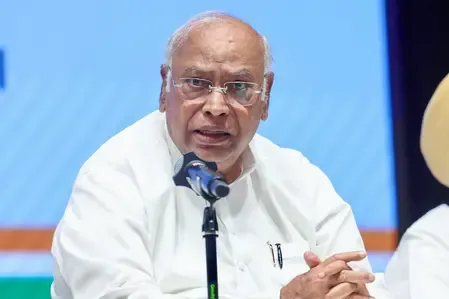

New Delhi, July 28 (NationPress) During a session on Monday, Finance Minister Nirmala Sitharaman announced that a total of 7,253 claims have been filed under the Unified Pension Scheme (UPS), with 4,978 claims successfully processed for benefits payment as of July 20.

The minister informed Parliament that there are 25,756 retired Central government subscribers qualified to receive additional advantages under the UPS.

According to her, these qualified subscribers include Central government employees who have superannuated, passed away, or retired under Fundamental Rules 56 (j) before March 31, 2025, after completing 10 or more years of qualifying service and who were part of the National Pension System (NPS).

The UPS has been set up as an option within the NPS specifically for Central government employees.

The minister noted that there are currently no plans to extend these benefits to other pension schemes or sectors.

Following requests from employees and their associations, the cutoff date to opt for the UPS has been extended by three months to September 30, 2025.

The government has also granted 'Retirement gratuity and Death gratuity' benefits under the Central Civil Service (Payment of Gratuity under National Pension System) Rules, 2021 to Central government employees participating in the UPS.

Additionally, employees opting for the UPS under NPS will also have the option to receive benefits under the CCS (Pension) Rules, 2021 or the CCS (Extraordinary Pension) Rules, 2023 in case of a government servant's death during service or discharge due to invalidation or disability.

Furthermore, the minister highlighted that tax benefits applicable to the UPS will mirror those of the NPS as per the Income Tax Act, 1961.

Earlier this month, the Finance Ministry declared that tax advantages available under the NPS would also apply to the UPS, thereby enhancing the scheme and providing significant tax relief and incentives for employees choosing the UPS.