What Does the Launch of GSTAT Mean for Taxpayers?

Synopsis

Key Takeaways

- GSTAT provides a nationwide platform for dispute resolution.

- Focus on transparency and efficiency in handling taxpayer appeals.

- Encourages digital filings and virtual hearings.

- Reduces delays and legal frictions in litigation.

- Supports the ease of doing business in India.

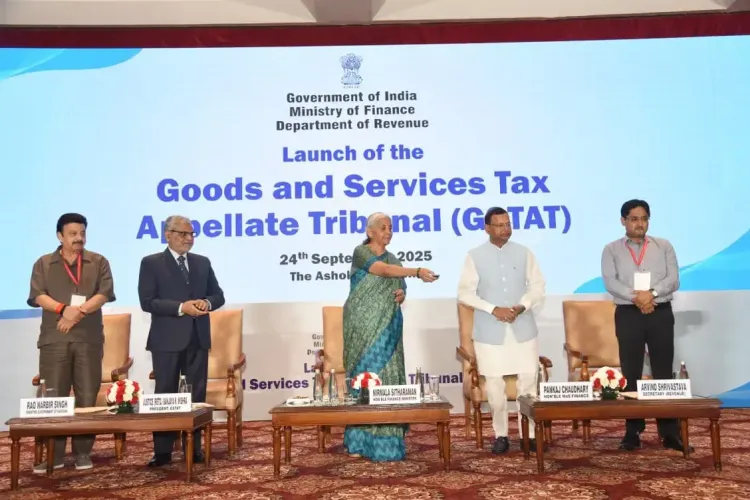

New Delhi, Sep 24 (NationPress) In a significant development for the Goods and Services Tax (GST) framework, Finance Minister Nirmala Sitharaman officially inaugurated the Goods and Services Tax Appellate Tribunal (GSTAT) today.

The GSTAT aims to establish a specialized, national platform that ensures consistency in interpretations, predictability in outcomes, and enhances the credibility of the appellate process.

Sitharaman emphasized that the introduction of the GSTAT is not merely an institutional accomplishment but a testament to the progress GST has achieved over the past eight years, serving as a powerful reminder of the government’s commitment to continuous improvement, reform, and adaptation for the future.

She highlighted that reform is an ongoing endeavor and that the GST must evolve with a focus on simplicity and ease of living.

"Following the principle of 'Nagarik Devo Bhava', we are prioritizing a citizen-centric approach that values time, transparency, and savings. The Next-Gen GST is realizing these goals, resulting in a nationwide GST Bachat Utsav this festive season across various sectors and daily life," she stated.

According to Sitharaman, the GSTAT's objectives should be explicit—providing decisions free from jargon, utilizing simplified formats and checklists, enabling digital filings by default, conducting virtual hearings, and establishing time standards for listings, hearings, and pronouncements.

"Our goal is clear: to minimize legal hurdles, enhance simplicity, and proactively address delays in litigation, enabling faster cash flows, empowering MSMEs and exporters to invest confidently while ensuring citizens benefit from the system," she explained.

The Finance Minister asserted that enhancing the taxpayer's living experience goes beyond filing and refunds; it also encompasses fair and efficient dispute resolution.

The GSTAT is viewed as a natural progression in the reform journey—an essential step for improving the business environment and providing a crucial forum for justice. To put it simply, when a taxpayer faces a dispute, the first appeal is directed within the tax administration.

"At the second tier, whether the original order originates from the Centre or a State, the appeal will now converge at a single, independent body—the GSTAT," she added.

Union Minister of State for Finance, Pankaj Chaudhary, remarked that this initiative is not just about launching a new system; it aims to deepen reforms that have consistently garnered support from Prime Minister Narendra Modi.

The underlying goal of these reforms is to enhance governance transparency, empower citizens, and bolster businesses.

"The establishment of the GST Appellate Tribunal is a vital step in this journey, making dispute resolution straightforward and accessible. It will offer a uniform, transparent, and reliable platform for resolving disputes, reducing ambiguity, ensuring consistency nationwide, and preventing both large and small taxpayers from experiencing prolonged waits for justice," he said.

With the introduction of the GST Appellate Mechanism, Chaudhary assured every taxpayer: "Your appeal will be heard, your rights safeguarded, and justice will not be delayed."