How is India’s Digital Public Infrastructure Enhancing Public Finance Management Services?

Synopsis

Key Takeaways

- Digital public financial management is key to India's fiscal savings.

- The PFMS facilitates real-time monitoring of fund flows.

- Integration with DBT minimizes subsidy leakages.

- Digital tools enhance revenue generation and compliance.

- Fiscal discipline is critical for maintaining economic stability.

New Delhi, Dec 6 (NationPress) India's public finance management practices are fundamentally anchored in digital public financial management, leading to significant fiscal savings. This development paves the way for increased growth-oriented capital expenditures while upholding fiscal discipline, as stated by a senior government official.

Anuradha Thakur, Secretary of the Department of Economic Affairs, remarked that establishing a solid implementation framework through public finance management practices is just as critical as having a supportive policy environment.

She highlighted several key components of India's digital public financial management, particularly the Public Financial Management System (PFMS). This unified platform facilitates real-time monitoring of fund transfers from the Union Government to states, agencies, and beneficiaries.

While addressing a seminar dedicated to sharing India's PFMS experiences with the Global South, the Secretary also pointed out the essential role played by the Civil Accounts Organisation in managing the PFMS platform.

Thakur noted that the integration of PFMS with Digital Payments and Direct Benefit Transfer (DBT) has guaranteed that subsidies and welfare benefits are delivered directly to the population, effectively reducing leakages and preventing duplication.

Moreover, the utilization of digital tools for revenue generation, such as e-invoicing, e-way bills, and faceless assessments, has expanded the tax base and curtailed evasion. These initiatives collectively have bolstered revenue flows and improved fiscal balance without raising tax rates.

The Secretary encapsulated the lessons learned from India's fiscal consolidation, emphasizing that a rules-based fiscal policy fosters discipline and credibility; regular mandatory disclosures alleviate information asymmetries that support efficient decision-making; and effective federal coordination mechanisms enhance compliance and alignment of fiscal objectives between the federal government and its constituent units.

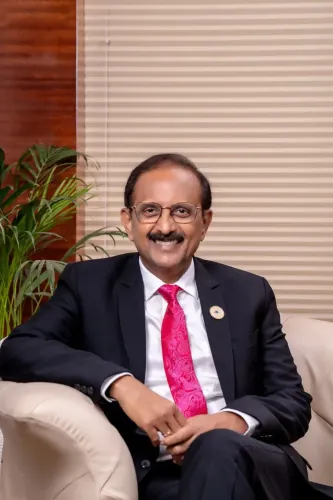

Sudhakar Dalela, Secretary for Economic Relations, praised India's globally acknowledged accomplishments in Digital Public Infrastructure (DPI), including identity systems, instant payments, and secure data-sharing layers, which have enhanced accountability and improved governance outcomes.

TCA Kalyani, Controller General of Accounts of India, underscored India's enduring commitment to custodial integrity in public finance, emphasizing the critical role of treasury discipline in governance.

Kalyani stressed that India's public finance management modernization is rooted in the principle of “Koshpoorvah Sarvarambhah”, which asserts that every government action must commence with a robust and accountable treasury.