India's First Mortgage-Backed Pass-Through Certificates: What Does It Mean for Investors?

Synopsis

Key Takeaways

- The first mortgage-backed PTCs have been successfully listed on the NSE.

- The issue size was Rs 1,000 crore with a full subscription.

- The coupon rate was determined through the NSE's EBP platform.

- These PTCs hold a AAA(SO) rating, ensuring high credit quality.

- This issuance represents a vital step in enhancing liquidity in the housing finance sector.

Mumbai, May 5 (NationPress) - In a significant milestone for India's housing finance and debt markets, the nation's inaugural mortgage-backed Pass-Through Certificates (PTCs) were officially listed on the National Stock Exchange (NSE) on Monday.

These PTCs, structured by RMBS Development Company Limited, are secured by a pool of housing loans initiated by LIC Housing Finance Limited.

The total issue size reached Rs 1,000 crore, consisting of 1,00,000 PTCs, each with a face value of Rs 1,00,000. The offering saw full subscription, showcasing robust investor enthusiasm.

This groundbreaking issuance marks the first of its kind in India, where the coupon rate was determined through the Electronic Book Provider (EBP) platform of the NSE.

The final coupon rate was established at 7.26 percent per annum, with a tenure of nearly 20 years.

The PTCs hold a premium AAA(SO) rating from both CRISIL and CARE Ratings and are issued in a dematerialized format, making them available for secondary market trading.

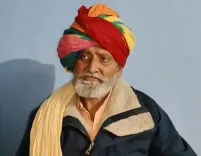

The listing was officiated by M. Nagaraju, Secretary of the Department of Financial Services, Ministry of Finance, who commemorated the occasion by ringing the ceremonial bell.

During his speech at the event, Nagaraju underscored the vital role of the housing and housing finance sectors within the broader economic context.

He acknowledged that housing is intricately linked with various industries, including infrastructure, and stressed the pressing need to address the nation's escalating housing demand to drive overall economic progress.

Nagaraju also noted that securitization, through instruments like these PTCs, can connect the housing finance market with the larger debt market.

Highlighting the significance of Residential Mortgage-Backed Securities (RMBS), he remarked that such instruments could revolutionize liquidity and bolster the growth of India's housing finance ecosystem.

The listing ceremony was attended by numerous senior officials from banks, housing finance companies, and various financial institutions, representing a pivotal move towards enriching the securitization market and expanding investment prospects in the nation.