Will Nil GST on Life and Health Insurance Enhance Affordability and Consumption?

Synopsis

Key Takeaways

- GST elimination on life and health insurance premiums enhances affordability.

- This change is part of a broader GST reform strategy.

- Policyholders will benefit from lower premiums.

- Insurers may face short-term profit margin pressures.

- Increased penetration in health insurance leads to improved access to healthcare.

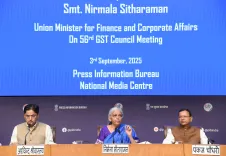

New Delhi, Sep 8 (NationPress) The recent GST adjustments on premiums for life and health insurance are set to greatly enhance affordability, boost market penetration, and elevate consumption during the upcoming festive period, experts noted on Monday.

This initiative is part of a larger GST restructuring, which has amalgamated the 12% tax tier with the 5% and reduced the 28% rate down to 18%.

Previously subjected to an 18% GST, health and life insurance premiums have now been transitioned to a zero tax bracket.

Per insights from ICRA, while policyholders stand to gain from reduced premiums, insurers might experience a temporary setback as the input tax credit (ITC) will no longer be accessible.

This situation may compress margins, particularly in the life insurance sector, yet the anticipated affordability improvements are likely to stimulate increased sales and enhance long-term market penetration.

For general insurance, the retail health division, which represented 16% of the industry's gross direct premium income (GDPI) in FY25, is expected to see a decline in premiums. However, the profitability of independent health insurers could be strained if the full advantage is passed on.

“The elimination of GST on health insurance premiums is set to improve affordability and accessibility for patients. As health insurance penetration rises, it will, in turn, support the hospital sector, which has already been experiencing a surge in demand owing to improved insurance coverage over recent years,” stated Jitin Makkar, Senior Vice President and Group Head of Corporate Sector Ratings at ICRA Limited.

In the long term, this initiative aligns with the government's ambition to make healthcare more inclusive and affordable, he added.

Experts believe this action will render life protection and healthcare coverage more accessible, especially for senior citizens, while fostering broader adoption of insurance products and reinforcing India’s financial safety net.

“Exempting GST on all individual life insurance policies, including term life, ULIP, or endowment plans, will enhance insurance penetration, particularly among first-time buyers and middle-income households,” remarked Balachander Sekhar, CEO and Co-founder of RenewBuy.