Can Revitalizing India’s Abandoned Shopping Centers Unlock Rs 357 Crore in Annual Rentals?

Synopsis

Key Takeaways

- 20% of India's shopping centers are ghost malls.

- Revitalizing 15 centers could yield Rs 357 crore in annual rentals.

- High vacancy rates and aging infrastructure characterize ghost malls.

- Tier 1 and Tier 2 cities present varied opportunities.

- Growth in organized retail is reshaping India's retail landscape.

New Delhi, Dec 9 (NationPress) Almost 20% of India's active shopping centers are categorized as 'ghost malls'. A recent report indicates that revitalizing only 15 of these centers, totaling 4.8 million square feet, could generate Rs 357 crore in annual rental income.

These 'ghost malls' are characterized by high vacancy rates, lackluster tenant selection, outdated infrastructure, and diminishing relevance.

Among 365 shopping centers, 74 have been classified as ghost assets, representing 15.5 million square feet of untapped retail potential.

“From this pool, we have identified 15 centers with a combined area of 4.8 million square feet that could yield an impressive Rs 357 crore in annual rental revenues if revitalized properly,” stated Knight Frank India in its latest report analyzing retail real estate across 32 cities in the country.

The report reveals that out of the 15 selected assets with viable revitalization prospects, tier 1 cities offer an opportunity of Rs 236 crore in annual rentals, while tier 2 cities contribute an additional Rs 121 crore.

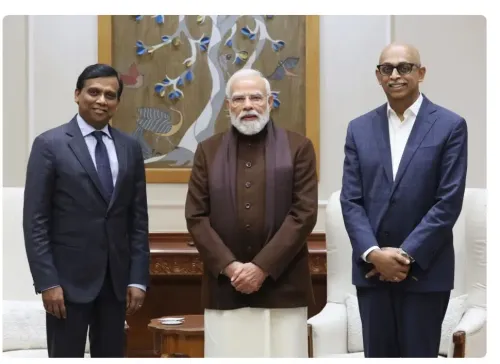

India's retail sector is entering a transformative growth phase, underpinned by robust consumer spending and a notable shift toward high-quality organized retail formats, noted Shishir Baijal, Chairman and Managing Director of Knight Frank India.

“Our analysis indicates that revitalizing 4.8 million square feet of dormant mall stock could yield Rs 357 crore annually, presenting a significant opportunity for developers and investors. With Grade A malls experiencing a mere 5.7% vacancy rate and numerous tier 2 cities showing strong absorption trends, the sector is well-positioned for future growth,” he added.

The study highlighted that the ghost mall issue is not limited to smaller cities or emerging markets. Tier 1 cities account for 11.9 million square feet of this dormant stock, while tier 2 cities contribute 3.6 million square feet.

Nonetheless, tier 1 cities are beginning to see a reduction in ghost shopping centers as redevelopment, new ownership models, design improvements, and alternative-use conversions breathe new life into aging assets.

“With a growing demand for flexible workspaces and evolving retail formats, dormant centers are regaining relevance. While Grade A malls continue to excel, lower-grade assets face challenges, prompting a shift in focus toward these revivable centers,” the report emphasized.

Tier 1 cities comprise 73% of India's shopping center inventory, yet several tier 2 cities such as Mysuru, Vijayawada, Vadodara, Thiruvananthapuram, and Visakhapatnam have shown remarkable performance with near-full occupancy and balanced tenant mixes, indicating a growing demand for organized retail beyond metropolitan areas.