Will SEBI Stand Firm Against Market Manipulation?

Synopsis

Key Takeaways

- SEBI is intensifying its efforts against market manipulation.

- Transparency in corporate governance is crucial.

- Jane Street has been barred from market access.

- Significant illegal gains have been identified.

- Compliance should not overwhelm businesses.

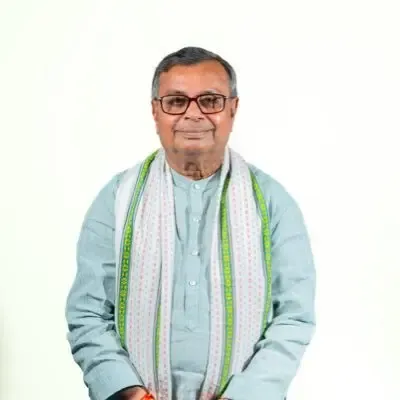

Mumbai, July 5 (NationPress) The Chairperson of the Securities and Exchange Board of India (SEBI), Tuhin Kanta Pandey, declared on Saturday that the regulatory body will be uncompromising regarding market manipulation. This statement came shortly after the US trading firm Jane Street and three of its associated entities were prohibited from market access.

During a media interaction, the SEBI head emphasized that the capital markets authority has intensified its surveillance against such illicit activities. He stated, “Market manipulation will not be tolerated.”

Speaking at an event hosted by the Bombay Chartered Accountants Society, Pandey stressed that ensuring transparency in related party transactions, managing conflicts of interest, and timely reporting of significant developments are essential responsibilities for chartered accountants.

“You must ensure that corporate governance is not merely a checklist exercise,” he remarked, noting that excessive compliance can create a substantial burden and expressing a desire for achieving better outcomes with reduced compliance.

SEBI has barred Jane Street and its three related entities from participating in the market, demanding that they deposit illegal earnings amounting to Rs 4,843.5 crore into an account designated for the market regulator.

Additionally, the regulator mandated a debit freeze on the bank accounts of these entities, including JSI2 Investments Private Ltd, Jane Street Singapore Pte. Ltd, and Jane Street Asia Trading Ltd. According to SEBI's order, Jane Street accrued Rs 43,289.33 crore in profits from trading in index options on Indian exchanges from January 1, 2023, to March 31, 2025.

This order is part of the enforcement actions taken by the market regulator and affects all entities of the Jane Street Group operating in India, curtailing their ability to trade or engage in any market-related activities.

Jane Street has contested the findings of SEBI's interim order and indicated plans to further engage with the regulatory body.