Is a Stable and Predictable Tax Policy the Key to Growth?

Synopsis

Key Takeaways

- Stable tax policy is essential for economic growth.

- Uncertainty in tax laws deters investment.

- Tax reforms aim to simplify compliance.

- New working group includes experts from various sectors.

- India must modernize its tax framework for future readiness.

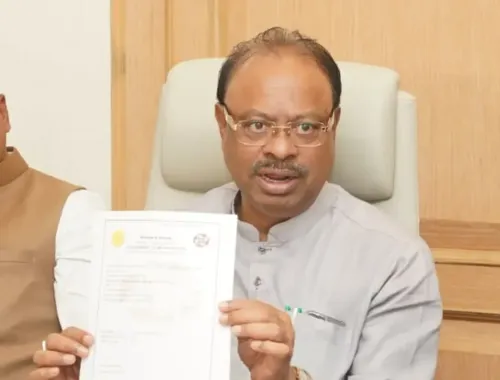

New Delhi, Oct 3 (NationPress) NITI Aayog CEO B.V.R. Subrahmanyam unveiled the inaugural working paper on tax policy, emphasizing that a stable, certain, and predictable tax structure is essential for enhancing investments, generating employment, and propelling India’s economic advancement.

During the announcement, Subrahmanyam remarked that uncertainty in tax regulations disheartens both businesses and investors.

“Uncertainty is detrimental to investment. It is also unfavorable for citizens. People seek stability, predictability, uniformity, and transparency in taxation,” he stated.

He noted that ambiguous tax laws susceptible to various interpretations result in confusion, disputes, and litigation.

This scenario not only hampers existing businesses in India but also deters potential investors.

“If a law can be interpreted in multiple ways, it suggests that taxes are enforced differently. This fosters disputes and repels investors. What investors desire is certainty,” he added.

A newly formed tax policy working group comprises experts from government sectors, tax authorities, and external specialists.

The group is tasked with devising comprehensive papers aimed at simplifying tax laws, streamlining compliance, and ensuring that India’s tax framework is future-ready.

Subrahmanyam also pointed to recent reforms like the launch of GST 2.0, which has simplified tax rates.

He indicated that the government aims to further rationalize tax processes and mitigate unnecessary complexities.

For instance, matters such as varying TDS rates, convoluted filing procedures, and overlapping provisions are under review to create a more business- and citizen-friendly system.

He stated that as India advances toward its vision of becoming a developed nation by 2047, it requires a modern and transparent tax framework.

“To attract more FDI and create jobs, we must provide investors with clarity on what to expect. A predictable tax system will empower them to plan with assurance,” he noted.

The CEO also emphasized that reforms will focus not only on tax rates but also on processes.

“Most individuals are compliant and willing to pay taxes. Issues arise when regulations are unclear or processes overly complicated. By simplifying taxes, compliance will naturally improve,” he said.

Describing the report as “a step forward”, Subrahmanyam stated that implementing the recommendations would enhance certainty and confidence for both Indian enterprises and global investors.

“This is vital for India to maintain rapid growth and attain its development objectives for 2047,” he added.