Will total market borrowings by states and UTs surpass Rs 2.81 lakh crore in Oct-Dec?

Synopsis

Key Takeaways

- States and UTs to borrow Rs 2.81 lakh crore.

- Tamil Nadu leads with Rs 39,000 crore.

- Uttar Pradesh follows with Rs 33,000 crore.

- Auctions begin on October 7.

- RBI aims for non-disruptive borrowing process.

Mumbai, Oct 3 (NationPress) The Reserve Bank of India (RBI) revealed on Friday that state governments and Union Territories are projected to secure Rs 2,81,865 crore through market borrowings in the upcoming October-December quarter of the current financial year.

Tamil Nadu stands out as one of the largest borrowers, aiming to raise Rs 39,000 crore during this period.

Uttar Pradesh, being the most populous state in India, has announced plans to borrow a total of Rs 33,000 crore across 11 auction rounds of Rs 3,000 crore each, while West Bengal intends to borrow Rs 29,000 crore.

Gujarat has stated its intention to raise Rs 20,000 crore through market borrowings in this quarter, while nearby Rajasthan aims for Rs 14,455 crore.

West Bengal, under Trinamool Congress governance, has informed the RBI of its plan to secure Rs 28,000 crore, distributed over 10 tranches, predominantly of Rs 3,000 each.

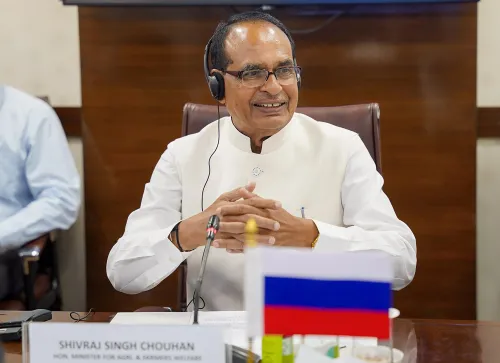

Election-bound Bihar has indicated a borrowing plan of Rs 9,800 crore, while Odisha aims to borrow Rs 9,000 crore in equal tranches of Rs 1,000 crore each. The mountainous state of Himachal Pradesh plans to mobilize Rs 1,500 crore, and neighboring Uttarakhand intends to raise Rs 4,000 crore. Madhya Pradesh is looking to gather around Rs 15,600 crore through debt.

Collectively, Indian states borrowed Rs 5 lakh crore via debt sales in the initial six months of the financial year concluding in March 2026. The new auctions are set to commence on October 7, with a total of 13 rounds planned until December 30. The RBI has released a comprehensive list of market borrowings by states. The borrowing calendar for states and Union Territories kicks off on October 7, a Tuesday, and will continue each subsequent Tuesday for 13 weeks until December 30.

The actual borrowing amounts and the specifics of the participating states/UTs will be communicated two or three days before the auction day, as stated by the Reserve Bank. The process will depend on the needs of the state governments and UTs, the approval from the Government of India under Article 293(3) of the Constitution, and prevailing market conditions.

The RBI affirmed that it would conduct the auctions in a non-disruptive manner, considering market conditions and other pertinent factors, ensuring an even distribution of borrowings throughout the quarter. The central bank also retains the authority to adjust auction dates and amounts in consultation with state governments and UT administrations.