Is the Congress Party's 'Gabbar Singh Tax' Critique of the BJP Government Justified?

Synopsis

Key Takeaways

- New GST rates have been implemented in Madhya Pradesh.

- Congress criticizes the BJP's previous tax policies.

- Proposal for GST refunds similar to Income Tax Returns.

- New structure simplifies GST into two rates.

- Awareness campaigns are being conducted by both parties.

Bhopal, Sep 22 (NationPress) As the fresh Goods and Services Tax (GST) rates take effect from Monday, the Congress in Madhya Pradesh intensified its criticism of the Bharatiya Janata Party (BJP) by referring to it as the 'Gabbar Singh Tax'.

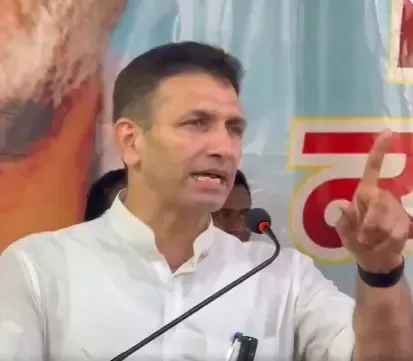

State Congress President Jitu Patwari addressed the media regarding the newly implemented GST rates, stating that the true advantages will only be realized when the money paid under previous rates since 2017 is refunded back to the citizens' bank accounts.

“While it’s commendable that the BJP-led central government has finally lowered GST rates and the public will benefit, what about the funds citizens lost under the 'Gabbar Singh Tax', which devastated countless lives, led to the closure of many small businesses, and caused widespread unemployment since 2017?” Patwari remarked.

In response to the BJP-led Madhya Pradesh government launching a state-wide awareness initiative to showcase the benefits of the new GST rates, Congress leader Patwari suggested that citizens would experience even greater relief if the state introduced a refund mechanism for GST similar to Income Tax Returns (ITR).

“We urge the BJP government to implement a GST refund policy for amounts collected under previous tax brackets, akin to the ITR system. Additionally, support should be extended to those who have suffered business losses and employment due to the 'Gabbar Singh Tax',” he emphasized.

Meanwhile, Chief Minister Mohan Yadav commenced a state-wide awareness campaign regarding GST, visiting shopkeepers in Bhopal's historic Chowk Bazaar on Monday.

He distributed copies of the GST resolution to traders and addressed their queries and concerns related to GST.

This awareness initiative will persist, as the Madhya Pradesh government aims to spread the message of GST reforms to all corners of the state.

In addition to the Madhya Pradesh government, the state BJP unit will also organize similar campaigns across all districts and blocks.

Under the new GST reforms, essentials such as daily food items, life and health insurance, automobiles, electronics, beauty services, and more will see a decrease in prices.

Luxury items will be taxed at 40%, while tobacco products will remain at 28% plus cess.

This represents the most significant overhaul since the inception of GST in 2017, transitioning from the previous structure of 5%, 12%, 18%, and 28% to just two rates—5% and 18%.