Did PM Modi Initiate GST 2.0 Over 18 Months Ago?

Synopsis

Key Takeaways

- GST 2.0 reforms aim to streamline the tax process in India.

- Developed over 18 months, these reforms are vital for economic growth.

- The changes are designed to benefit 140 crore Indians.

- Farmers and MSMEs will receive significant support through GST rate cuts.

- Compensation to states for tax shortfalls ceased in June 2022.

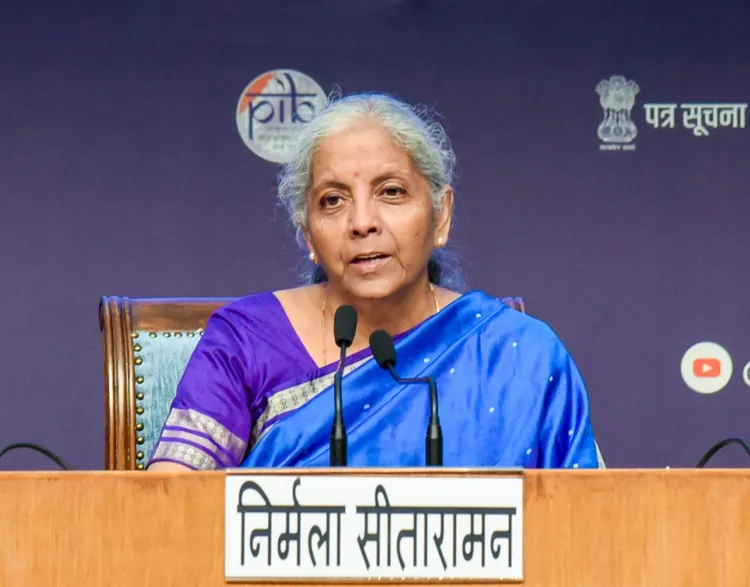

New Delhi, Sep 9 (NationPress): Finance Minister Nirmala Sitharaman indicated on Tuesday that the Next Gen GST 2.0 reforms, introduced by the government under PM Modi, have been under development for over 18 months and are unrelated to the tariff increases imposed by the United States.

While speaking at the NDTV Profit conclave, the Finance Minister recalled that during the Union Budget presentation, PM Modi had reminded her of the ongoing GST reforms.

"There wasn't a crisis triggered by US tariff actions," the Finance Minister clarified. She noted that it was in May when she recognized that there was a significant proposal ready to present to the Prime Minister.

“We are assessing the consequences of the US tariff hikes,” Sitharaman added.

All state finance ministers showed support for tax rate reductions during the GST Council meeting.

"To give credit to state finance ministers, they were unanimously in favor of rate rationalization," Sitharaman stated.

She emphasized that there was no hostility at any stage, although states reiterated their concerns regarding revenue impact on several occasions.

Nonetheless, she made it clear that the Centre's compensation to states for shortfalls in tax collections ceased in June 2022.

"As of 2022, there is no compensation," the Finance Minister stated when questioned about states' grievances regarding compensation.

She further explained that the compensation cess being collected currently is earmarked for repaying loans acquired during the Covid-19 pandemic.

"Enhanced collection efficiency leads to improved overall collections, it's not as if the Centre has a large sum set aside to compensate everyone," she remarked.

She highlighted that the reforms would benefit 140 crore Indians, significantly aiding farmers and MSMEs that are pivotal in driving the economy and generating employment through GST rate reductions.

When asked why the stock markets did not react more robustly to the Next Gen reforms part of the GST 2.0 package, the Finance Minister pointed out that stock markets are influenced by numerous factors, including the current global uncertainties.

In response to another inquiry, she stated, "I do monitor the stock markets, but my primary concern is the impact of reforms on India's citizens. I aim for the reforms to resonate positively with the populace, rather than focusing on market performance. I’m not particularly worried about market fluctuations.”