Has GST 2.0 Rationalized Tax Rates and Increased Revenues?

Synopsis

Key Takeaways

- GST 1 focused on unifying various tax structures.

- GST 2.0 aims to simplify and rationalize tax rates.

- Enhanced compliance could lead to increased tax revenues.

- Two major sectors, petroleum and liquor, remain outside GST.

- Stakeholder consensus was vital for implementing GST.

New Delhi, Sep 5 (NationPress) A concise interpretation circulating about the two phases of the Goods and Services Tax (GST) suggests that while GST 1 focused on unification, GST 2.0 is centered around simplification.

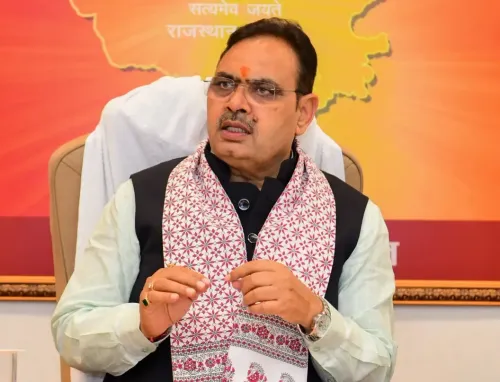

“One can view GST 1 as a framework that addressed the concerns of all involved parties,” stated Navin Kumar, the inaugural chairman (March 2013-August 2017) of GST Network (GSTN).

The initial aim was to consolidate the Value Added Tax (VAT), service tax, and several other levies into a singular tax structure. The landscape included state VAT, Central VAT, and service tax.

“Hence, GST 1 was fundamentally about unification,” he elaborated.

“During the drafting of the GST law, tax officials sought to ensure that the tax obligations would not result in a decline in revenue for either the state or Central government,” continued Kumar, a former Chief Secretary of the Government of Bihar (September 2011-August 2012).

They encountered a challenging situation as each state had distinct interests and conditions.

“Consequently, many provisions were included in the initial GST to ensure consensus among stakeholders. This meant that all parties agreed to implement GST, which explains the variety of tax rates,” clarified the retired IAS officer.

This raises the question: why wasn’t a more straightforward, single-rate or perhaps a two-slab system introduced in GST 1? Various countries operate with a single rate or only two rates. Why implement such a multitude of tax brackets?

“Every nation has its own unique circumstances. In India, for instance, it would be inconceivable to charge the same rate for food items as for an air-conditioner or a car,” he pointed out.

Thus, it became necessary to establish different tax rates for the Centre and states to agree. He acknowledged that while it may not have been the ideal solution, it was the most acceptable option at the time.

From an economist's or financial manager's perspective, having a single rate would be preferable; it would eliminate confusion, making the law simpler to understand and comply with, he conceded.

Critics argued that the previous structure was ineffective and lacked efficiency, necessitating corrective measures.

“Since 2017, when GST 1 launched, stakeholders have recognized that fewer tax slabs will lead to greater efficiency,” he noted.

At first, there was reluctance to embrace the new regime due to fears of financial losses for governments. To alleviate these concerns, the Centre introduced compensation.

“There were indeed challenges in implementation and collection; some states experienced losses, which were compensated by the Central government,” added Kumar, who also served as Secretary of the Ministry of Urban Development (2010-2011).

“Currently, tax collections are increasing, and the compensation is no longer necessary. Both the states and Central government are now in a comfortable position, as revenues have risen,” he emphasized.

Another inquiry pertains to why these reforms took eight years to materialize.

“Reform or correction is informed by real-world experiences. This is why the insights gained since 2017 demonstrate that GST is a sustainable tax system, and simplifying compliance could lead to higher tax revenues,” he stated.

What is Kumar's perspective on GST 2?

“GST 2 has initiated a rationalization of tax rates. Moving from a multi-slab system to two main rates is a significant advancement,” he asserted.

Ultimately, he remarked, “I believe that with the restructured GST framework, revenue will undoubtedly increase.”

Two major sectors yet to be included under GST are petroleum and liquor. Kumar indicated that there is already a consensus that the former will be incorporated into GST once an agreement is reached with the states.

As for the latter, he anticipates it will eventually be included as well, “at some future point.”