Will the GST reform simplify ITC refunds for risk-evaluated taxpayers?

Synopsis

Key Takeaways

- Refunds for risk-evaluated taxpayers can be processed within 7 days.

- GST registration can be granted within 3 working days for eligible small businesses.

- Small businesses can opt for a simplified registration process.

- The indirect tax structure has been streamlined from four slabs to two.

- Value thresholds for GST refunds on low-value exports have been eliminated.

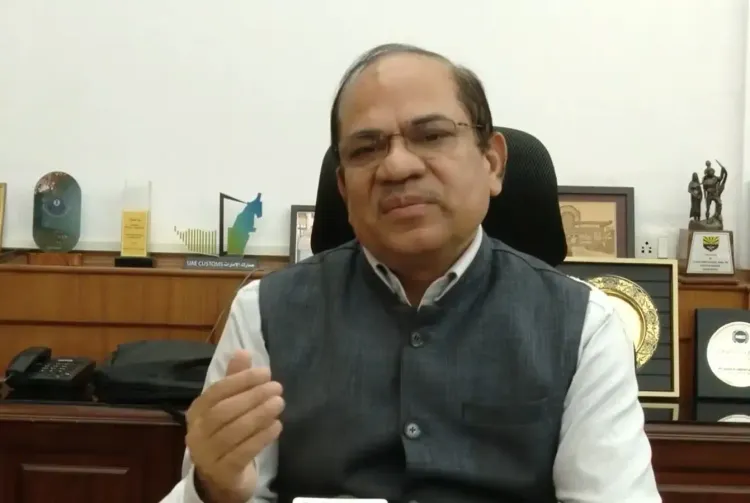

New Delhi, Sep 10 (NationPress) The GST Council has proposed that for a recognized and risk-assessed taxpayer, a refund can be processed within seven days and without the need for an officer's involvement, stated the Chairman of the Central Board of Indirect Taxes and Customs (CBIC), Sanjay Kumar Agarwal.

During a conversation with IANS, Agarwal explained that for exports, the supply is classified as zero-rated, allowing for a refund of the accumulated input tax credit (ITC) associated with such supplies.

“The GST Council has now recommended that for an identified and risk-evaluated taxpayer, a refund can be issued within 7 days and without any officer's intervention,” he mentioned.

Previously, Agarwal noted that to enhance the ease of doing business, the GST registration process has been streamlined, particularly for small businesses and low-risk applicants.

Under the revised system, eligible applicants will receive registration within three working days.

Small businesses projecting that they will not utilize more than Rs 2.5 lakh of input tax credit can choose this simplified registration.

“This registration will be automatically granted by the system within three working days. Should they expand and wish to transition to the standard registration, provisions exist for a transition based on risk analysis,” Agarwal added.

The Centre has optimized the indirect tax framework, reducing the current four slabs to two, eliminating the 12 percent and 28 percent rates while retaining the 5 percent and 18 percent categories.

In a move that will benefit e-commerce exporters, the GST Council has endorsed DGFT’s proposal to abolish the value threshold for GST refunds on low-value items.

The pertinent section of the CGST Act, 2017, will be revised to permit refunds for exports made with tax payment, irrespective of value.

This long-anticipated reform addresses the challenges faced by small exporters, particularly those using courier or postal services, and is expected to simplify processes significantly, thereby fostering low-value e-commerce exports, as per the Commerce Ministry.