Is PM Modi Overhauling GST Just in Time for Diwali?

Synopsis

Key Takeaways

- Establishment of a high-level task force for governance reforms.

- Significant reductions in GST rates on household items are expected.

- PM Modi emphasized the urgent need for a review of GST rates.

- GST has unified India's indirect tax structure since its launch in 2017.

- Upcoming reforms aim to enhance transparency and equity in the tax system.

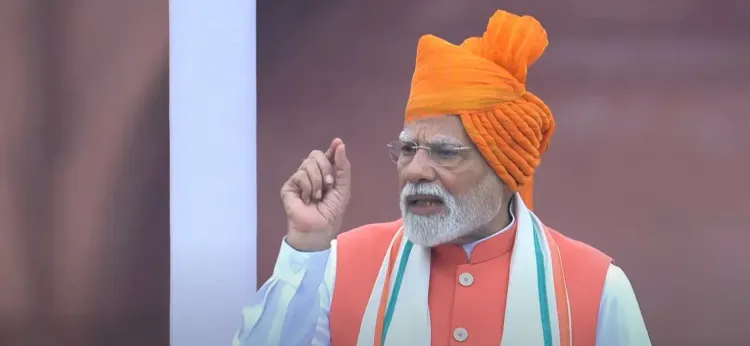

New Delhi, Aug 15 (NationPress) Prime Minister Narendra Modi made a significant announcement on Independence Day, revealing the establishment of a high-level task force dedicated to driving next-generation reforms in governance, taxation, and public service delivery.

Speaking from the historic Red Fort, PM Modi stated, “We are forming a task force for next-generation reform. Our goal is to implement comprehensive reforms across the board.”

In a festive spirit, the Prime Minister hinted at a “double Diwali” celebration for the nation this year, foreshadowing a substantial economic announcement.

“This Diwali, I’m planning to bring you a double Diwali. Citizens will receive a major gift, with significant reductions on GST for essential household items,” he proclaimed, indicating extensive changes to the Goods and Services Tax (GST) framework.

PM Modi stressed the pressing need for a review of GST rates, labeling it the “need of the hour.”

He shared that the government is crafting a new-generation GST reform aimed at alleviating the tax burden on everyday citizens.

“We will drastically lower GST rates. Taxes will be reduced for the common man,” he asserted.

This announcement coincides with the eighth anniversary of GST, a landmark reform in India's post-independence tax landscape. Since its implementation in 2017, GST has unified the nation’s indirect tax system, significantly enhancing the ease of doing business, especially for small and medium enterprises.

PM Modi’s statements resonate with recent reports indicating record GST collections and increasing support from businesses for further simplification.

The anticipated reforms are expected to simplify rate structures, improve transparency, and create a more equitable system.

The Prime Minister's dual message of structural reform and festive cheer sets the stage for a transformative era in India’s economic policy.

As the task force embarks on its mission, expectations are high for a comprehensive GST overhaul that provides relief to consumers while maintaining revenue growth.

With Diwali on the horizon, citizens and businesses eagerly await the “big gift” that Modi has promised—a redefined tax system that has the potential to reshape India’s fiscal landscape.