Is SEBI Chief Warning Investors About Fraudsters Offering Guaranteed Returns?

Synopsis

Key Takeaways

- Digital tools have enabled fraudsters to mislead investors.

- Only 36% of investors have adequate knowledge of the securities market.

- SEBI emphasizes the importance of investor education.

- Significant growth in Indian investors, reaching 134 million.

- Actual market participation is only 9.5% of households.

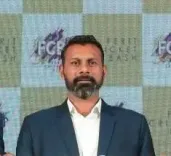

Mumbai, Oct 6 (NationPress) The Chairman of SEBI, Tuhin Kanta Pandey, emphasized on Monday that while the advancement of digital infrastructure has made market access effortless, it has simultaneously equipped fraudsters with sophisticated tactics to mislead investors. Unsolicited messages on various messaging platforms, questionable influencers, and counterfeit trading applications and websites are luring investors with promises of guaranteed returns, which our markets can never genuinely provide.

During the launch of the week-long observance of 'World Investor Week 2025' in India, themed 'Fraud and Scams Prevention and Basics of Investing', Pandey highlighted that this initiative is part of a global campaign by the International Organization of Securities Commissions (IOSCO) aimed at promoting the significance of Investor Education and protection.

Pandey shared insights from a market survey conducted by SEBI, revealing that only 36 percent of investors possess a high or moderate understanding of the securities market. This knowledge gap presents a vulnerability, making investors more susceptible to fraud.

The securities markets serve as the lifeblood of our nation's economic growth, and it is crucial that we uphold strong foundations of integrity and transparency.

The extensive survey, which surveyed over 90,000 households and was carried out in collaboration with AMFI, NSE, BSE, NSDL, and CDSL, provides a clear, data-driven overview of India's investment landscape. The findings from this survey will guide efforts to make our markets more inclusive and secure, Pandey noted.

He remarked on the significant rise in the number of Indian investors over recent years, attributing this growth to enhanced accessibility, simplified onboarding processes, and increased awareness. The unique investor count in the securities market ecosystem has surged to 134 million.

“Our survey indicates that an impressive 63 percent of Indian households, equating to 213 million households, are aware of at least one securities market product. However, our challenge lies in transforming awareness into action,” Pandey stated.

The data reveals that actual participation is merely 9.5 percent of households, which translates to approximately 32 million households. While this figure is notable, it underscores the extensive opportunity for growth, he added.

Later, addressing the media, the SEBI Chairman affirmed, “Whenever our team identifies non-registered influencers associated with SEBI, or receives related complaints, we undertake a comprehensive investigation. If we determine that they are misleading the public or breaching SEBI regulations, we escalate the issue to the platform providers.”

“Platforms such as Google, Meta, X, and Telegram respond by taking necessary actions to eliminate these influencers. We compile and share data every three months, and with each new data set, we conduct further analysis. We have already noted a decrease in such violations,” he mentioned.