How will the GST rate cut combat the US tariff hike while India continues buying Russian oil?

Synopsis

Key Takeaways

- GST rate cuts aim to boost economic growth.

- India will continue purchasing Russian oil.

- New GST structure simplifies rate categories.

- Focus on passing benefits to consumers.

- Measures will support those impacted by tariffs.

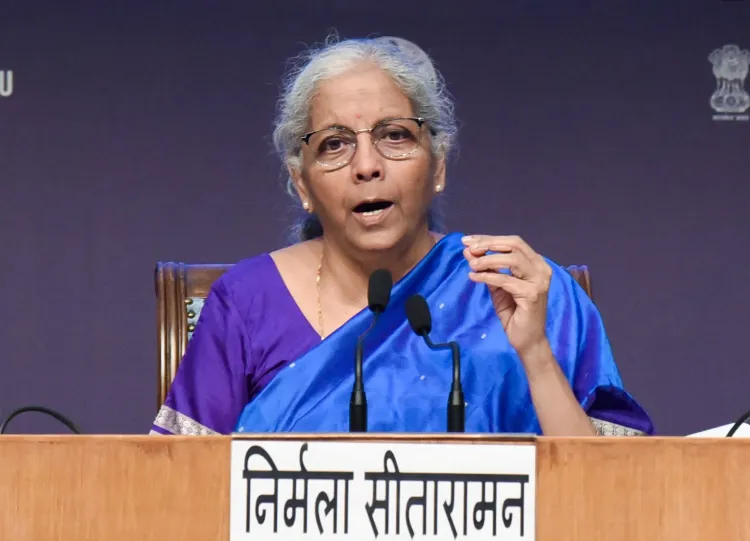

New Delhi, Sep 5 (NationPress) Finance Minister Nirmala Sitharaman stated on Friday that the GST rate reduction would catalyze economic growth, counterbalancing the negative effects of the US tariff increase on Indian exports. She affirmed that India will persist in purchasing Russian oil due to economic factors, as crude oil represents the most expensive component in the nation’s import expenditures.

The government’s primary objective is to ensure that the GST reductions on various goods and services, effective from September 22, are transferred to consumers,” Sitharaman mentioned during a media briefing.

“We will be undertaking significant work after September 22. It’s a comprehensive vigilance initiative, and we are optimistic that the advantages will reach the average citizen,” the Finance Minister remarked.

FM Sitharaman also indicated that the government is engaging with various stakeholders to oversee price reductions, with all industry leaders committed to lowering prices on goods to pass the benefits of the GST rate cuts on to consumers.

The Finance Minister noted, “Following the GST Council's decision to lower GST rates, Members of Parliament are taking on the responsibility of monitoring the price reductions in the field.”

Regarding the western pressure on India to halt oil purchases from Russia, the Finance Minister clarified that the government’s oil procurement is determined by economic factors such as pricing and logistics expenses. She emphasized that “since oil constitutes a significant foreign exchange concern and is the most costly item in India’s import bill, we will undoubtedly continue purchasing Russian oil.”

Addressing the consequences of the USA’s 50% punitive tariff on the Indian economy, the Finance Minister remarked that the GST cuts will elevate domestic demand and stimulate growth, mitigating the negative impact on exports. She also mentioned that the government will introduce measures to assist those affected by the tariff hike.

The two-slab GST framework of 5% and 18%, replacing the previous 12% and 28% rates, is expected to lower prices on most goods and services. Additionally, a 40% tax on luxury and sin goods like pan masala, tobacco, carbonated beverages, high-end vehicles, yachts, and private jets ensures fairness and revenue stability.

Moreover, registration and return filing processes have been streamlined, refunds expedited, and compliance costs reduced, alleviating the burden on businesses, particularly MSMEs and startups.

Sitharaman also shared that Prime Minister Narendra Modi had approached her eight months ago to discuss revitalizing the GST structure.

PM Modi stressed the necessity to simplify the system, focusing on alleviating the burden on the middle class, she added.

She further elaborated that GST 2.0 has been structured to minimize disputes and provide clarity for both businesses and state governments.