How is Baba Ramdev Responding to GST Reforms?

Synopsis

Key Takeaways

- GST reforms introduce two main tax slabs of 5% and 18%.

- Essential goods will become cheaper, easing household burdens.

- Baba Ramdev commends the reforms as a significant step towards Viksit Bharat.

- Patanjali commits to passing on GST benefits to consumers.

- The reforms aim to boost production and savings across the nation.

Haridwar, Sep 4 (NationPress) Yoga guru Baba Ramdev expressed his support for the recent GST reforms on Thursday, emphasizing that the extensive tax reductions represent a significant leap towards achieving the vision of 'Viksit Bharat'.

He claimed that these modifications will enhance production, stimulate the economy, and augment individual savings.

The GST Council has sanctioned comprehensive changes to the indirect tax framework, streamlining the number of tax slabs and decreasing rates on numerous essential goods and services.

Under the revised system, only two main slabs of 5 percent and 18 percent will persist, along with a higher 40 percent rate for sin goods. Officials indicated that the new arrangement will leave citizens with more disposable income, which the government anticipates will reinvest into the economy and foster growth.

Several products, including groceries, footwear, textiles, fertilizers, and renewable energy items, will witness a price drop. Goods that were previously taxed at 12 percent and 28 percent will largely transition to the two main slabs, alleviating the financial burden on households.

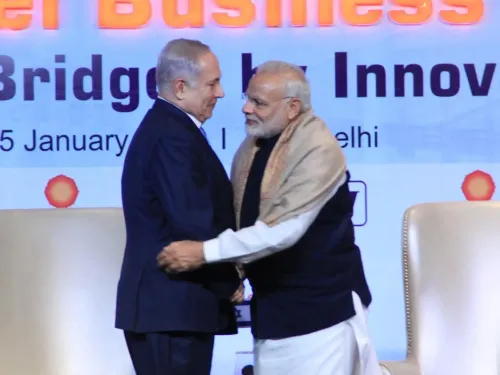

In a statement to reporters, Ramdev, who is also the founder of Patanjali, remarked, “Prime Minister Narendra Modi has taken a significant step by reducing GST for consumers, citizens, and households. This impactful decision will enhance production, stimulate the economy, and raise individual savings. As savings increase, individuals will have more capacity to purchase their essential needs.”

He underscored the reduction of GST on essential items, particularly daily necessities, labeling it a “very historic step”.

Ramdev acknowledged that there may be a “loss of GST amounting to lakhs of crores of rupees”, but insisted that India would recover from this through robust growth.

The council has also instituted a 40 percent tax rate on sin and luxury goods, elevating it from the current 28 percent, effective September 22. The GST 2.0 reform has consolidated taxes into primarily two slabs of 5 percent and 18 percent, while products like tobacco, sugary beverages, and high-end vehicles have been moved to the 40 percent category.

Reacting to this, Ramdev noted, “One positive aspect is that all harmful items, especially tobacco and alcohol, will be taxed at 40 percent. This change will resolve various accounting issues.”

He connected the reforms to the Prime Minister’s broader vision for the nation.

“As India emerges as a growing global economy, the Prime Minister has a dream of establishing Viksit Bharat; these reforms will propel India in that direction. We express our gratitude to the Prime Minister for this initiative,”

he added.

Ramdev also assured that Patanjali would extend the benefits of GST reductions to consumers.

“On behalf of Patanjali, I assure that from ghee to biscuits, soap, shampoo, toothpaste, and all daily products, we will take swift measures to reduce prices and provide advantages to our customers. For us, the country is not merely a market; it is a family,” he concluded.