Will Restrictions on Bangladesh RMG Imports Boost Indian Manufacturers?

Synopsis

Key Takeaways

- Restrictions on RMG imports are now in place from Bangladesh.

- Domestic RMG manufacturers may benefit from increased costs for imports.

- India's textile industry is set for a potential boost.

- Strategic response to Bangladesh's cotton yarn export ban.

- Local sourcing may enhance self-reliance in the apparel sector.

New Delhi, May 18 (NationPress) The government's initiative to impose restrictions on all forms of readymade garments (RMG) from Bangladesh via land ports is set to raise the import costs of these garments and generate fresh prospects for local RMG manufacturers, as stated by the Confederation of Indian Textile Industry (CITI) on Sunday.

According to a recent announcement from the office of the Director General of Foreign Trade (DGFT), India has halted the import of all types of readymade garments from Bangladesh through land routes.

Trade statistics reveal that India imported RMG amounting to $634 million in 2024, marking a notable growth rate of 19 percent CAGR over the past decade.

The majority of these imports were conducted via land routes, making the new restriction likely to significantly affect RMG imports, according to the confederation.

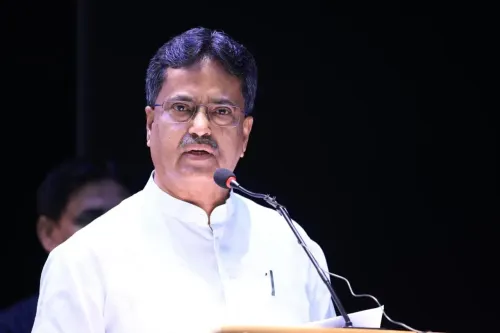

In April 2025, Bangladesh implemented a ban on the export of cotton yarn to India, which has historically constituted nearly 45 percent of India's total cotton yarn exports. The latest action by the Indian government is viewed as a robust and tactical response to this unilateral trade barrier imposed by Bangladesh,” remarked Rakesh Mehra, Chairman of CITI.

Mehra emphasized that this decision will likely elevate the costs of Bangladesh garment imports and open up new avenues for domestic RMG producers, while also allowing Indian cotton yarn exporters to shift their supply to the local market in response to the anticipated demand gap.

“This could serve as a vital stimulus for the Indian textile value chain by promoting local sourcing and enhancing self-sufficiency in the apparel sector,” he added.

In a substantial shift in trade policy, India has recently limited the import of RMG, processed foods, and other goods from Bangladesh through land ports, effective immediately. However, this restriction will not apply to Bangladeshi goods passing through India bound for Nepal and Bhutan, as announced by the DGFT in its notification.