Will the New Income Tax Bill Simplify Tax Filing for Common Citizens and Small Businesses?

Synopsis

Key Takeaways

- The new income tax bill aims to simplify tax filing.

- It could reduce the complexity of the current tax law by nearly 50%.

- Small businesses and MSMEs will benefit significantly.

- The bill is expected to be tabled during the Monsoon Session.

- Bipartisan cooperation was key to the committee's success.

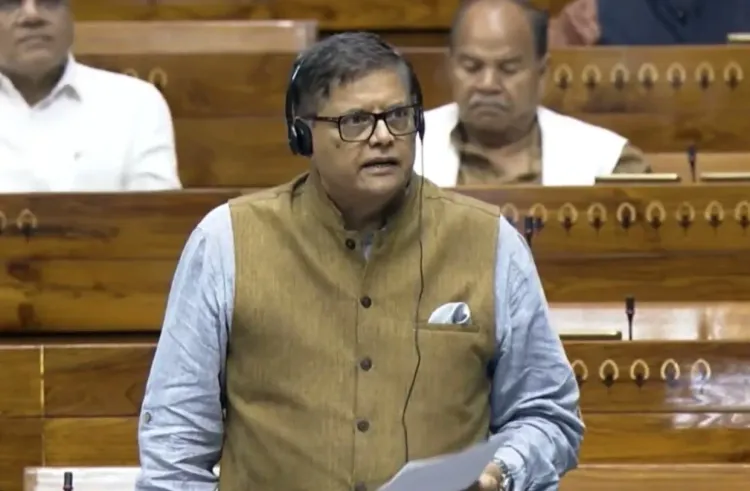

New Delhi, July 22 (NationPress) - The proposed income tax bill aims to streamline tax filing for everyday citizens and small enterprises, according to BJP MP Baijayant Jay Panda, who led the Parliamentary Select Committee tasked with evaluating this legislation.

In a discussion with IANS, he stressed that the new law, upon approval, will modernize India’s long-standing tax framework, reduce legal ambiguities, and aid individual taxpayers and MSMEs in steering clear of needless legal conflicts.

Panda remarked, "The existing Income Tax Act of 1961 has seen over 4,000 amendments and comprises more than 500,000 words. Its complexity has escalated significantly. The new bill intends to cut that down by almost 50%, making it substantially easier for general taxpayers to comprehend," he explained to IANS.

He pointed out that the primary beneficiaries of this simplification will be small business proprietors and MSMEs who frequently lack the legal and financial acumen to navigate intricate tax regulations.

“Unlike larger corporations that can afford tax advisors and legal consultants, MSMEs and average taxpayers face challenges. A more straightforward law translates to fewer disputes and enhanced compliance,” he stated.

The Select Committee, under Panda’s guidance, conducted 36 consecutive meetings over several months.

The committee consulted with over a hundred stakeholders, including industry representatives and independent experts.

Panda expressed pride in the fact that not a single meeting was deferred, and no requests for extensions were made, showcasing this committee as an exemplary model of effective parliamentary operation.

The report, containing over 300 recommendations, has been submitted ahead of schedule and is anticipated to be presented during the ongoing Monsoon Session.

“If approved, the new legislation could come into effect as of April 1 next year,” he added. Panda attributed this achievement to collaborative, bipartisan efforts.

"There was no political maneuvering. Every member concentrated on simplifying tax laws for the advantage of taxpayers. It was a genuine collective endeavor for the national good," he told IANS.

“While the bill does not alter tax policies—remaining under the jurisdiction of the Finance Bill and the Union Budget—it establishes a modern, simplified framework that enables existing and future tax policies to be executed more transparently and effectively,” he further explained.

Panda also clarified that the committee did not suggest any policy shifts but ensured that the legal framework encompasses all recent reforms and is accessible to every citizen.

"Simplifying the law itself aids in policy implementation and mitigates confusion for both taxpayers and tax administrators," he concluded.