NestAway Controversy Ignites Discussion on VC Dominance in Startups

Bhubaneswar, Jan 3 (NationPress) The recent controversy surrounding NestAway, a home rental service, where co-founder Amarendra Sahu lodged an FIR against purported corporate misconduct, has once again brought to the forefront the escalating worries regarding venture capitalist (VC) influence in Indian startups. Such narratives are not singular; they underscore a fundamental dilemma afflicting India's startup landscape.

While Silicon Valley flourishes with tales of companies like Amazon and Apple evolving from concepts to global leaders, India's story often falters due to external financial dominance.

Numerous Indian entrepreneurs find themselves ceding control of their firms to VCs, who invest substantially yet frequently acquire majority stakes, relegating the original founders to minimal equity and limited authority.

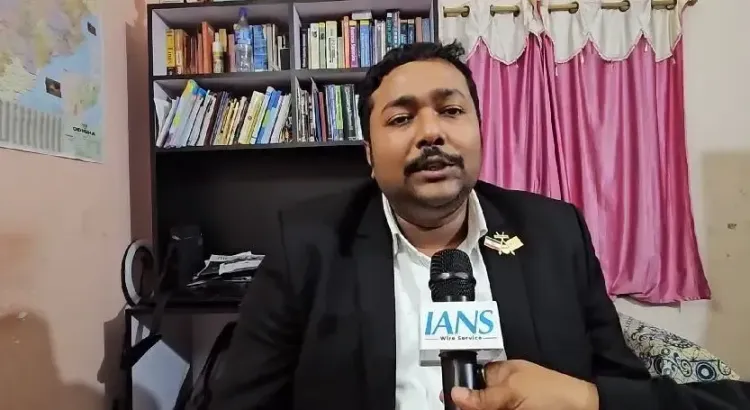

In an exclusive conversation with IANS, Sakya Singh Mohapatra, founder of Sak Robotics, voiced his apprehensions: "There is no law in our country to safeguard the rights of entrepreneurs in disputes with venture funds. Despite NCLT and SEBI regulations, no framework guarantees equitable dispute resolution for founders."

Mohapatra elaborated on the difficulties, mentioning that founders' equity can diminish to as little as 5 to 15 percent in various scenarios.

Even though the firm's brand is built on the entrepreneur's vision, VCs frequently overshadow them in decision-making and governance.

He also highlighted the expensive and impractical arbitration process in foreign nations like Singapore, which further disadvantages Indian founders.

IANS has gained exclusive insights from industry insiders and sources close to the NestAway situation, illuminating the legal and financial upheaval that has shaken India's startup ecosystem.

A company once valued at Rs 1,800 crore in 2020 was sold for a mere Rs 90 crore in cash, despite raising Rs 700 crore in funding, marking a staggering decline in valuation.

During the pandemic, all co-founders, except Sahu, departed from the firm, leaving it in a vulnerable state.