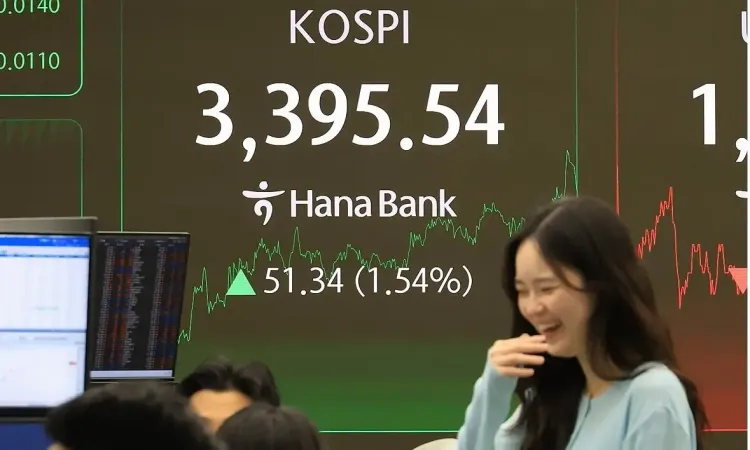

Will S. Korea's Equity Benchmark Hit 4,000 in 12 Months?

Synopsis

Key Takeaways

- Projected stock benchmark of 4,000 in 12 months.

- Potential rise to 5,000 is feasible.

- Global monetary policy easing is a significant factor.

- South Korea's strength in advanced technology sectors.

- Investor confidence may increase with improved shareholder returns.

Seoul, Sep 29 (NationPress) An analyst from JPMorgan Chase has projected that South Korea's stock benchmark could reach approximately 4,000 within the next year. Mixo Das, head of Korea equity strategy at JPMorgan, shared this forecast during a presentation at the Korea Capital Market Conference, which commenced earlier today in Seoul.

According to Das, "Our target price for the next year is around 4,000, with a favorable scenario potentially pushing it to 5,000 or even higher." He cited three main reasons for his optimistic outlook, notably the synchronized global easing of monetary policies that originated in the United States.

"Globally, we maintain a bullish stance on risk assets at this time," Das elaborated. He anticipates that investors will gravitate towards riskier assets and equities, a trend he believes will manifest worldwide.

Additionally, Das emphasized South Korea's prowess in advanced technologies, including sectors such as defense, shipbuilding, and high bandwidth memory utilized in artificial intelligence (AI) data centers, as a further justification for the positive forecast.

He pointed out that these industries are expected to retain their competitive edge in the global market, as many are deemed sensitive to national security and are shielded from Chinese competition by government protections.

Nevertheless, Das urged Korean firms to enhance shareholder returns to further bolster investor confidence. He also mentioned that ongoing governmental policy initiatives, including the anticipated corporate code reform, should be directed positively.

"From the perspective of numerous investors, this is a critical moment to observe how these regulations or regulatory actions unfold," he stated.

The conference, organized by the Korea Exchange (KRX), convened officials from various local and international financial entities.