Why Did Samvardhana Motherson’s Q1 Net Profit Plummet by 44.7%?

Synopsis

Key Takeaways

- Q1 FY26 net profit down by 44.76%.

- Revenue increased by 4.7% to Rs 30,212 crore.

- Operating performance showed weakness with an 11.4% drop in EBITDA.

- Margins fell to 8.1% from 9.6%.

- Chairman emphasizes inorganic growth opportunities.

Mumbai, Aug 13 (NationPress) The Indian multinational automotive parts manufacturer, Samvardhana Motherson, revealed a significant year-on-year (YoY) decline of 44.76 percent in its net profit, reporting Rs 606 crore for the first quarter of the fiscal year 2025-26 (Q1 FY26), a drop from Rs 1,097.2 crore in the same quarter of the previous fiscal year (Q1 FY25).

Despite this profit downturn, the company experienced a 4.7 percent increase in revenue, climbing to Rs 30,212 crore from Rs 28,868 crore in the previous year, as indicated in its stock exchange filing.

However, the operational performance showed signs of strain, with EBITDA decreasing by 11.4 percent to Rs 2,458 crore compared to Rs 2,775 crore from the previous year.

The margins also fell to 8.1 percent from 9.6 percent, reflecting challenges in operational efficiency.

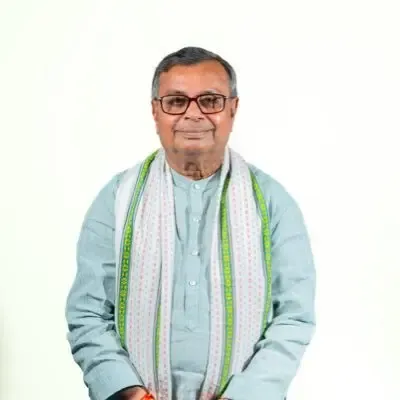

Following the earnings report, Chairman Vivek Chaand Sehgal stated that the new tariffs imposed on India by the US President Donald Trump administration are not expected to have a considerable impact on the company's operations.

“While uncertainties exist in the business landscape, they also provide potential avenues for inorganic growth,” remarked Sehgal.

He emphasized that most of Motherson's sales in the US comply with the US-Mexico-Canada (USMCA) trade agreement, and cost pass-through agreements with customers are underway, albeit with some delays.

Sehgal further noted that despite the uncertain global business environment, it also offers prospects for growth through acquisitions.

“Moreover, the recently implemented tariffs on India do not significantly influence our operations. While there are ongoing uncertainties, they also present opportunities for inorganic growth. The trust bestowed upon us by our customers remains a crucial factor for our success,” he indicated.

“Our teams worldwide remain dedicated to fulfilling our vision and generating long-term value for our stakeholders,” added Sehgal.

In the wake of these financial results, shares of Samvardhana Motherson surged by 3.3 percent to reach a daily high of Rs 93.28. Nonetheless, the stock has seen a 28 percent decline over the past year and is down 10 percent thus far in 2025.