How is PaRRVA Set to Deliver Reliable Performance Data for Intermediaries?

Synopsis

Key Takeaways

- PaRRVA aims to provide credible performance data for investors.

- It enhances transparency and standardization in financial metrics.

- Intermediaries can submit data securely through API integration.

- Nearly 50 risk-return metrics will be calculated and shared with investors.

- Investors can easily access reports via QR codes or links.

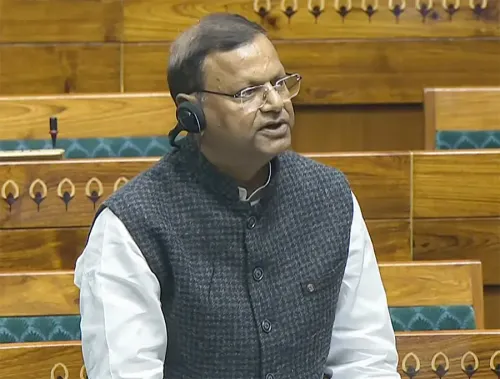

New Delhi, Dec 8 (NationPress) During the launch of the Past Risk and Return Verification Agency (PaRRVA), Securities and Exchange Board of India (SEBI) Chairman Tuhin Kanta Pandey stated that this platform aims to provide investors with credible performance data while allowing regulated entities to demonstrate authentic performance to clients.

PaRRVA represents a pioneering global initiative aimed at validating risk-return metrics for investment advisors, research analysts, and trading members, as per SEBI's announcement regarding the pilot launch.

“Transparency for investors is fundamental to sustainable market growth,” remarked the SEBI Chairman, emphasizing that PaRRVA strengthens SEBI's ongoing dedication to ensuring that India’s securities markets remain fair, transparent, orderly, and resilient.

Pandey expressed that PaRRVA will provide investors with “clarity and confidence” by enhancing transparency and standardization in the performance claims made by financial intermediaries.

Ashishkumar Chauhan, MD & CEO of the National Stock Exchange (NSE), described PaRRVA as a vital initiative led by SEBI for improving transparency, standardization, and investor trust in performance disclosures.

“NSE is excited to support this venture by offering the PaRRVA Data Centre (PDC), which will facilitate the use of validated market data for thorough risk and return verification,” stated Chauhan.

The system guarantees that all risk-return metrics presented to investors are independently validated and adhere to verification methodologies developed in consultation with industry stakeholders.

Intermediaries can submit their recommendations via secure API-based integration or file uploads, after which the PaRRVA – PDC performs a detailed validation and computes risk and return metrics.

Nearly 50 distinct risk and return matrices are calculated based on transaction data sourced directly from stock exchanges and clearing corporations, which will be made available to investors through the PaRRVA platform.

Investors can also access reports by scanning a QR code or visiting a link that directs them to the official PaRRVA portal.

PaRRVA enhances compliance by preventing the selective presentation of returns, avoiding claims specific to clients, and ensuring that each metric is substantiated with the necessary disclosures, according to the statement.

The platform’s secure data architecture and T+1 validation for portfolios, along with end-of-day checks for intraday strategies, ensure both speed and accuracy.