Does Pakistan's Exit from the Greylist Protect It from Money Laundering and Terror Financing?

Synopsis

Key Takeaways

- FATF warns Pakistan against complacency.

- Countries must enhance measures against financial crimes.

- Digital wallets pose new risks in terror financing.

- Continued international scrutiny is expected.

- Delisting does not equate to immunity.

Paris, Oct 25 (NationPress) The global watchdog for terror funding, Financial Action Task Force (FATF), has issued a warning to Pakistan, stating that its removal from the 'greylist' in October 2022 does not exempt it from international scrutiny regarding terror financing and money laundering.

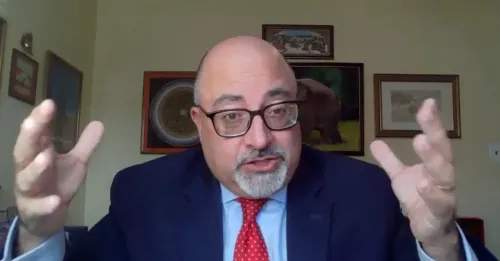

During a press conference in France following the FATF plenary session, FATF President Elisa de Anda Madrazo stressed the importance for countries, including Pakistan, to remain alert and dedicated to tackling illicit financial activities even after being delisted.

"Any nation that has previously been on the greylist is not invulnerable to the actions of criminals — whether they are money launderers or terrorists. We urge all jurisdictions, including those that have been removed from the list, to continue their diligent efforts in preventing and deterring these crimes," Madrazo stated.

Pakistan was taken off the FATF 'greylist' in October 2022 and is currently under follow-up to guarantee the implementation of anti-terror financing policies.

However, as Pakistan is not a member of FATF, the Asia Pacific Group (APG) has been overseeing the follow-up process.

This list includes various nations and jurisdictions that are under increased surveillance due to significant strategic shortcomings in their efforts against terror financing and money laundering, as highlighted by the FATF President.

"Being delisted does not signify the conclusion of the process," Madrazo added.

"We expect nations to enhance their systems and close loopholes that criminals exploit."

These remarks come amidst reports indicating that Pakistan-based terror organizations like Jaish-e-Mohammad (JeM) are utilizing digital wallets and concealed financial flows to support training camps — a new risk identified in the FATF's recent 'Comprehensive Update on Terrorist Financing Risks' report.

India's National Risk Assessment 2022 has recognized Pakistan as a high-risk source of terror financing, particularly through entities associated with the state-run National Development Complex (NDC).

The FATF report, which incorporates inputs from India, highlights ongoing regional threats stemming from state-sponsored terrorism and proliferation financing.

"The FATF is committed to enhancing global standards and ensuring implementation through thorough assessments and monitoring," Madrazo stated.

"Our objective is straightforward — to deny terrorists and criminals access to the funds they depend on."

The Paris plenary concluded with the endorsement of two new mutual evaluation reports based on updated, results-oriented criteria.

Belgium and Malaysia were the first nations evaluated under the new framework, which prioritizes tangible outcomes over procedural adherence.

The FATF also announced the removal of Burkina Faso, Mozambique, Nigeria, and South Africa from the grey list after successfully completing their action plans.