Will India’s Credit Rating Upgrade Enhance Investor Confidence and Attract Foreign Investment?

Synopsis

Key Takeaways

- India's credit rating upgraded by S&P Global

- Long-term rating raised to 'BBB'

- Short-term rating upgraded to 'A-2'

- Stable outlook reflects strong economic fundamentals

- Foreign capital inflows expected to increase

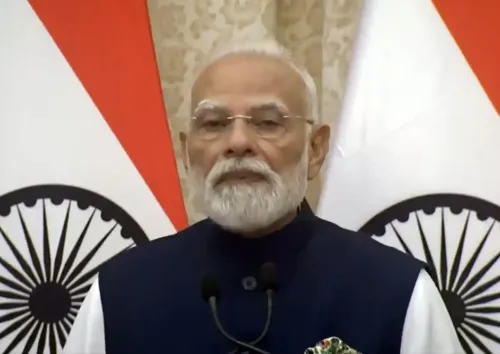

New Delhi, Aug 16 (NationPress) The recent upgrade of India’s sovereign credit rating by S&P Global highlights the nation’s robust economic fundamentals, prudent fiscal management, and effective monetary policies, according to an official statement released on Saturday.

S&P Global has elevated India’s long-term sovereign credit rating from 'BBB-' to 'BBB', and the short-term rating from 'A-3' to 'A-2'. The stable outlook indicates strong confidence in India's economic fundamentals and responsible policy management.

The transfer and convertibility assessment has also been upgraded to 'A-' from 'BBB+', acknowledging India's growing financial resilience. This rating upgrade is significant as it follows an 18-year gap since the last upgrade in January 2007.

“This improvement reflects confidence in India's capability to sustain its growth, control inflation, and invest in infrastructure while ensuring financial stability. This achievement underscores the government’s commitment to long-term prosperity and establishes India as a resilient and appealing destination for global investors,” the statement remarked.

The enhanced rating is anticipated to lower sovereign borrowing costs and bolster investor confidence, potentially leading to increased foreign capital inflows.

Such developments will foster a more stable environment for financing both public and private sector investments, thus supporting infrastructure growth, job creation, and widespread economic development in the future.

S&P Global asserts that India remains one of the top-performing economies globally, exhibiting strong resilience and consistent growth since the pandemic.

Real GDP growth has averaged 8.8 percent from fiscal 2022 to fiscal 2024, the highest in the Asia-Pacific region. S&P predicts an annual GDP growth of 6.8 percent over the next three years, which should aid in moderating the government debt-to-GDP ratio.

The quality of government spending has improved, emphasizing infrastructure investment. Union government capital expenditure is projected to reach Rs 11.2 trillion (3.1 percent of GDP) by fiscal 2026.

“Total public investment in infrastructure, including contributions from state governments, is estimated at approximately 5.5 percent of GDP, rivaling or surpassing many peer nations. Investments in infrastructure and connectivity are expected to eliminate bottlenecks that have historically hindered long-term economic growth. Monetary policy reforms, especially the shift towards inflation targeting, have stabilized price expectations,” the official statement noted.

S&P Global has also pointed out that the Indian government is pursuing a clear and gradual approach to fiscal consolidation, enhancing the country’s economic stability and credibility.

The general government deficit, which indicates the gap between total government spending and revenue, is projected to decrease from 7.3 percent of GDP in fiscal 2026 to 6.6 percent by fiscal 2029. The provisional fiscal deficit of the central government for fiscal 2025 is recorded at 4.8 percent of GDP, while the Union Budget has further lowered the target to 4.4 percent of GDP for fiscal 2026.

State government deficits are anticipated to average 2.7 percent of GDP over the next three to four years.

S&P Global emphasizes that India’s robust economic growth and sound policy framework have fortified the country’s credit profile while keeping inflation in check.