How is India Post Payments Bank Processing Billions of Digital Transactions and Enabling Doorstep Services?

Synopsis

Key Takeaways

- IPPB has over 12 crore customers.

- It processes billions of digital transactions.

- Doorstep banking services are available in rural areas.

- Innovative products enhance customer convenience.

- IPPB is a leader in financial inclusion.

New Delhi, Sep 3 (NationPress) India Post Payments Bank (IPPB), which recently marked its eighth anniversary on IPPB Day, has successfully surpassed the 12-crore customer milestone, according to the Ministry of Communications.

This achievement represents a significant transformation in the banking sector, ensuring that services are inclusive, accessible, and affordable for all.

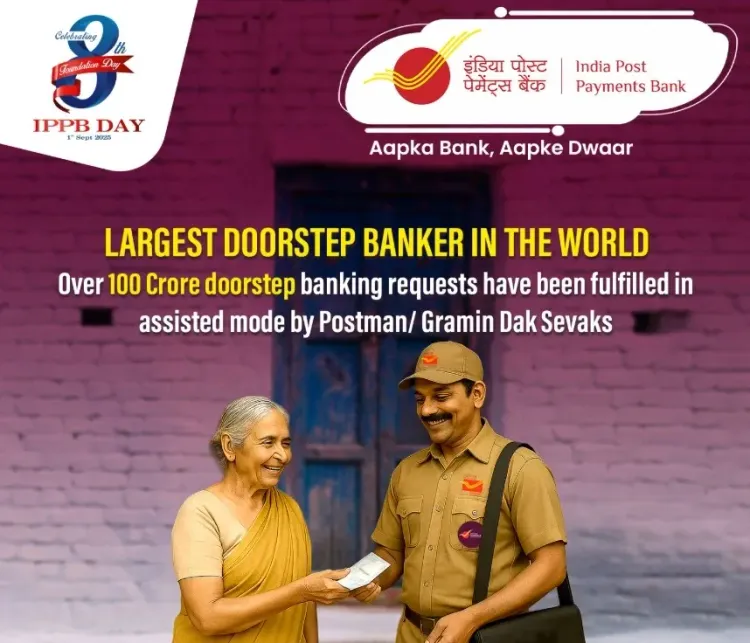

Since its launch in September 2018, IPPB has rapidly developed into one of the world’s largest financial inclusion initiatives, utilizing the extensive network of over 1.64 lakh post offices and more than 1.90 lakh postmen and gramin dak sevaks (GDS), as stated by the Ministry.

“The bank has successfully enrolled over 12 crore customers, executed billions of digital transactions, and facilitated doorstep banking services in rural, semi-urban, and remote areas,” it noted.

“IPPB has proven that financial inclusion is not merely a concept but a tangible reality. Through our distinctive postal banking model, we have empowered millions of Indians, especially in rural and underserved areas, by bringing banking directly to their homes,” remarked Vandita Kaul, Chairman of IPPB.

“Our journey establishes a global benchmark for the delivery of last-mile financial services. Celebrating our 8th Foundation Day is even more significant as we have achieved the 12 Crore Customer milestone,” she added.

The Ministry also highlighted recent innovations that have enhanced IPPB’s offerings. The bank has expanded its services to include end-to-end DBT disbursements, pension payments, credit facilitation through partnerships, and insurance and investment products in collaboration with various institutions.

New initiatives such as DigiSmart (Digital Savings Accounts), the Premium Aarogya Savings Account (Bank Account with Healthcare Benefits), and Aadhaar-based Face Authentication have introduced new levels of customer convenience and the immediate availability of digital banking services.

The RuPay Virtual Debit Card, AePS (Aadhaar-enabled Payment Services), cross-border remittances, and Bharat BillPay integration have already positioned IPPB as a comprehensive provider of financial services at the grassroots level.

On our 8th Foundation Day, we take pride in IPPB’s role in transforming access to financial services for over 12 crore customers. Our Postmen and GDS have become bankers for the common citizen, facilitating transactions worth lakhs of crores at their doorsteps. With the introduction of digital payments and various customer-centric services, we are constructing a robust and inclusive financial ecosystem. The future of banking lies at the last mile, and IPPB is at the forefront of that transformation,” stated R. Viswesvaran, MD and CEO of IPPB.