Will SBI Revise IMPS Charges from August 15?

Synopsis

Key Takeaways

- New IMPS charges will be effective from August 15.

- Small-value transfers remain free up to Rs 25,000.

- Charges apply for amounts above Rs 25,000.

- Exemptions are available for salary package account holders.

- IMPS transactions have a limit of Rs 5 lakh.

New Delhi, Aug 13 (NationPress) The State Bank of India (SBI) is set to adjust its Immediate Payment Service (IMPS) fees for retail clients starting August 15. This new structure will introduce minimal charges for select high-value online transactions, while maintaining free services for smaller transfers.

Under this updated policy, all customers will continue to enjoy complimentary online IMPS transfers up to Rs 25,000.

As per the reports, fees will be implemented for transactions exceeding Rs 25,000: Rs 2 + GST for transfers between Rs 25,000 and Rs 1 lakh, Rs 6 + GST for amounts exceeding Rs 1 lakh up to Rs 2 lakh, and Rs 10 + GST for transfers from Rs 2 lakh to Rs 5 lakh.

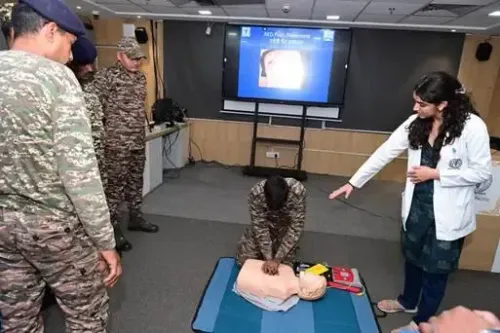

Notably, these revised fees will not affect salary package account holders across various government, defence, and corporate categories, as they will continue to benefit from waivers for online IMPS transactions, as stated in the reports.

This includes all types of Defence Salary Package (DSP), Para Military Salary Package (PMSP), Indian Coast Guard Salary Package (ICGSP), Central Government Salary Package (CGSP), Police Salary Package (PSP), Railway Salary Package (RSP), Shaurya Family Pension Accounts, Corporate Salary Package (CSP), State Government Salary Package (SGSP), Startup Salary Package (SUSP), and Family Savings Account–SBI Rishtey.

The fees for IMPS transactions through branches remain unchanged, ranging from Rs 2 + GST for the lowest tier to Rs 20 + GST for the highest tier.

IMPS, a real-time payment system provided by the National Payments Corporation of India (NPCI), operates 24/7 with a transaction limit of Rs 5 lakh (excluding SMS and IVR channels).

While transactions at branches, ATMs, and IVR do not require prior setup, customers utilizing mobile banking, internet banking, or SMS banking must complete registration in advance, according to reports.

For transactions below Rs 1,000, Canara Bank currently offers free IMPS services. After that, fees range from Rs 3 + GST (for transactions between Rs 1,000 and Rs 10,000) to Rs 20 + GST (for transactions between Rs 2 lakh to Rs 5 lakh).

Higher-value transactions incur costs of Rs 12 + GST at branches and Rs 10 + GST online.

The Punjab National Bank waives fees for transactions up to Rs 1,000, charging Rs 6 + GST at branches or Rs 5 + GST online for amounts up to Rs 1 lakh.

Customers are advised to closely examine the updated rates in light of SBI's changes to maximize applicable exemptions based on their account category and avoid unexpected deductions.