How Has the Sukanya Samriddhi Yojana Empowered Over 4.53 Crore Girls Since 2015?

Synopsis

Key Takeaways

- Over 4.53 crore accounts have been opened since 2015.

- Total deposits in SSY accounts have exceeded Rs 3.33 lakh crore.

- Accounts can be opened for girls aged up to 10 years.

- Only one account is allowed per girl child, with a maximum of two accounts per family.

- Current interest rate stands at 8.2 percent per annum.

New Delhi, Jan 21 (NationPress) Since the inception of the Sukanya Samriddhi Yojana (SSY) in 2015, a remarkable total of over 4.53 crore accounts have been established to enhance the future prospects of girls, as reported by the government on Wednesday.

Initiated in January 2015 as part of the Beti Bachao, Beti Padhao initiative, this scheme aims to bridge the gap between financial security and social transformation.

By motivating families to plan ahead for their daughters’ education and overall well-being, SSY has fostered a sense of confidence, inclusion, and long-lasting advancement at the grassroots level. According to official statements, deposits in SSY accounts have surpassed Rs 3.33 lakh crore as of December 2025.

“As the SSY marks its 11th anniversary on January 22, it stands as a testament to the collective faith of millions of families in the promise of their daughters,” the statement noted.

“Since its launch, more than 4.53 crore accounts have been opened, with total deposits exceeding Rs 3,33,000 crore by December 2025,” it continued.

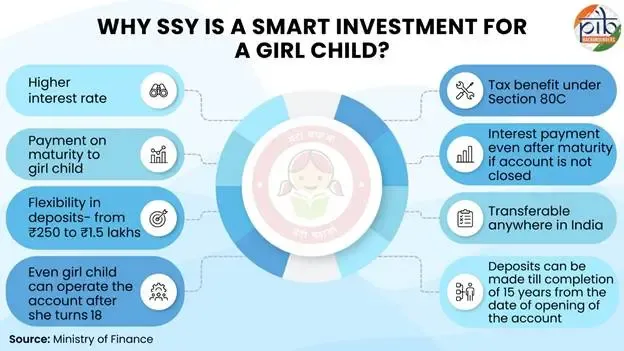

To take advantage of the scheme, parents or legal guardians can open an account for their girl child at any India Post office or any branch of public sector banks and authorized private sector banks (including HDFC Bank, Axis Bank, ICICI Bank, and IDBI Bank).

Accounts can be opened from the birth of the girl child until she turns 10 years old.

Only one SSY account is permitted per girl child, and families can open accounts for a maximum of two girl children.

The account is also transferable across any location within India.

Significantly, the account is managed by the parent or guardian until the girl child reaches 18 years. After turning 18, the account holder can assume control of the account by providing the necessary documentation.

The account can commence with a minimum deposit of Rs 250, with a maximum annual deposit limit of Rs 1,50,000.

Deposits can be made for up to fifteen years from the date of account opening.

This scheme is designed to foster long-term financial security for the girl child by offering attractive returns, tax benefits, and flexible withdrawal options for education and future needs.

Furthermore, it provides a competitive interest rate, which is periodically announced by the Ministry of Finance, aiding savings to grow steadily over time.

The current interest rate for the SSY scheme is 8.2 percent per annum, making it one of the highest among savings instruments dedicated to daughters,” the statement emphasized.

“As India moves towards greater gender equality and inclusion, SSY plays a crucial role in ensuring that every girl has the resources and confidence she needs to thrive and realize her full potential,” it concluded.