How Will GST Reforms Enhance Affordability and Accessibility in Healthcare?

Synopsis

Key Takeaways

- GST rates for life-saving drugs reduced to 5% or zero.

- Essential medical devices now more affordable.

- Implementation date for changes: September 22.

- Lower and middle-class consumers will benefit the most.

- Healthcare access is set to improve significantly.

New Delhi, Sep 4 (NationPress) Experts in the healthcare sector have indicated that the recent Goods and Services Tax (GST) reforms are set to significantly enhance both affordability and accessibility within the healthcare sphere.

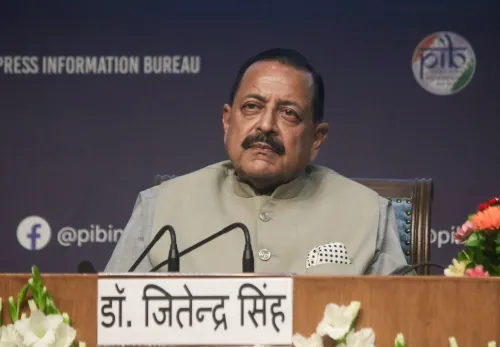

During a meeting of the GST Council, led by Finance Minister Nirmala Sitharaman, the decision was made to streamline the indirect tax framework. This revision has reduced the number of tax slabs from four to two, eliminating the 12 percent and 28 percent categories while maintaining the 5 percent and 18 percent slabs.

According to the new regulations, critical medications, health-related products, and certain medical devices will experience a reduction in tax rates from 12 percent or 18 percent to 5 percent or even zero.

Importantly, the GST rates for 33 cancer drugs and various rare medications have been decreased from 12 percent to zero percent.

The implementation of these GST rate changes for services is scheduled for September 22.

Rajiv Nath, Forum Coordinator for the Association of the Indian Medical Device Industry (AiMeD), expressed to IANS that this groundbreaking decision to lower the GST from 12 percent to 5 percent is a major win for consumers and patients. He emphasized that this reform will significantly enhance affordability and accessibility, ultimately reducing excess costs in healthcare.

Sushil Suri, Managing Director of Morepen Laboratories, noted that these reforms have been long-awaited and represent a substantial advancement for the nation. He referred to it as a big bonus for the common people, highlighting that many medicines have seen their GST rates drop from 12 percent to 5 percent, and some from 18 percent to 5 percent.

Himanshu Baid, Managing Director of Polymedicure, remarked that the government's decision to cut GST rates will make essential home care products more affordable. He pointed out that items such as thermometers, glucometers, blood pressure instruments, bandages, and diagnostic kits will now be taxed at 5 percent. This change is expected to greatly benefit the lower and middle classes who have been facing financial strain.