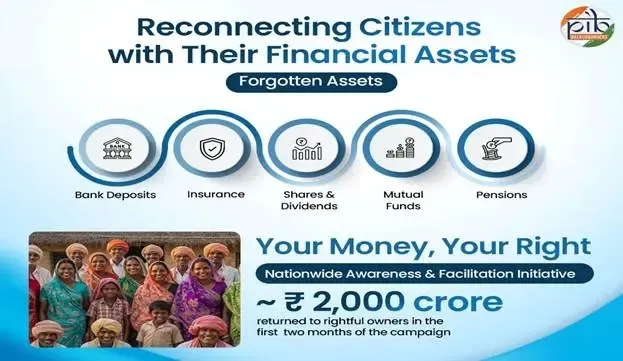

How is the Govt Returning Rs 2,000 Crore in Unclaimed Savings?

Synopsis

Key Takeaways

- Government initiative aims to reclaim unclaimed savings.

- Nearly Rs 2,000 crore returned to rightful owners.

- Unclaimed assets include bank deposits, insurance proceeds, and mutual funds.

- Collaboration with major financial regulators.

- Focus on raising public awareness regarding unclaimed assets.

New Delhi, Dec 26 (NationPress) The government has successfully retrieved nearly Rs 2,000 crore in unclaimed savings from various financial institutions, including banks, insurance, mutual funds, dividends, shares, and retirement benefits, as stated in an official announcement made on Friday.

This initiative is part of the Centre's campaign titled “Your Money, Your Right,” launched in October 2025, aiming to assist citizens in identifying and reclaiming their unclaimed financial assets. The project is managed by the Finance Ministry’s Department of Financial Services, with collaboration from financial regulators reaching out through digital platforms and district-level assistance.

Over generations, families across India have diligently saved by opening bank accounts, purchasing insurance, investing in mutual funds, and setting aside funds for retirement. These financial choices are often made with an intent to provide for children’s education, address healthcare needs, and ensure a dignified life in old age.

Unfortunately, a considerable amount of these hard-earned funds has remained unclaimed over time. However, this money has neither disappeared nor been misused; it remains secure with regulated financial institutions, separated from its rightful owners due to factors like lack of awareness, outdated records, relocation, or missing documentation. Many families are often unaware of the existence of such assets.

The total volume of unclaimed financial assets in India is substantial, spanning various sectors of the formal financial system. Estimates suggest that Indian banks alone hold approximately Rs 78,000 crore in unclaimed deposits, with unclaimed insurance policy proceeds nearing Rs 14,000 crore and Rs 3,000 crore in mutual funds yet to be claimed. Also, unclaimed dividends account for around Rs 9,000 crore, according to official statistics.

These figures highlight the magnitude of unclaimed savings belonging to citizens that remain untouched, even though they are securely stored within the financial system.

Your Money, Your Right is a nationwide initiative designed to reconnect citizens with these overlooked financial assets and ensure that the funds that rightly belong to individuals and families are returned to them.

Unclaimed financial assets arise when money held by financial institutions is not claimed by the account holder or their legal successors for an extended period. These assets may include:

- Bank deposits such as savings accounts, current accounts, fixed deposits, and recurring deposits that have remained inactive for ten years or more.

- Insurance policy proceeds that have not been claimed past the due date.

- Mutual fund redemption proceeds or dividends that could not be credited due to issues like a change in bank account, closure of bank accounts, or incomplete records.

- Dividends and shares that are unclaimed and have been transferred to statutory authorities.

- Pension and retirement benefits that have not been claimed within the standard timeframe.

In most instances, assets become unclaimed due to life changes such as job relocations, changes in contact information, closure of old bank accounts, or lack of knowledge among family members and heirs.

The Government is collaborating with the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), the Securities and Exchange Board of India (SEBI), the Investor Education and Protection Fund Authority (IEPFA), and the Pension Fund Regulatory and Development Authority (PFRDA) to assist citizens in locating, accessing, and reclaiming financial assets that legally belong to them through straightforward processes and transparent systems.