Will GST Rate Cuts on 11 Bengal-Specific Items Elevate the State’s Economy?

Synopsis

Key Takeaways

- GST rates reduced to 5% for 11 Bengal-specific items.

- Effective from September 22, just before Durga Puja.

- Supports local artisans and farmers.

- Expected to boost the state’s economy.

- Collaboration among states for effective reforms.

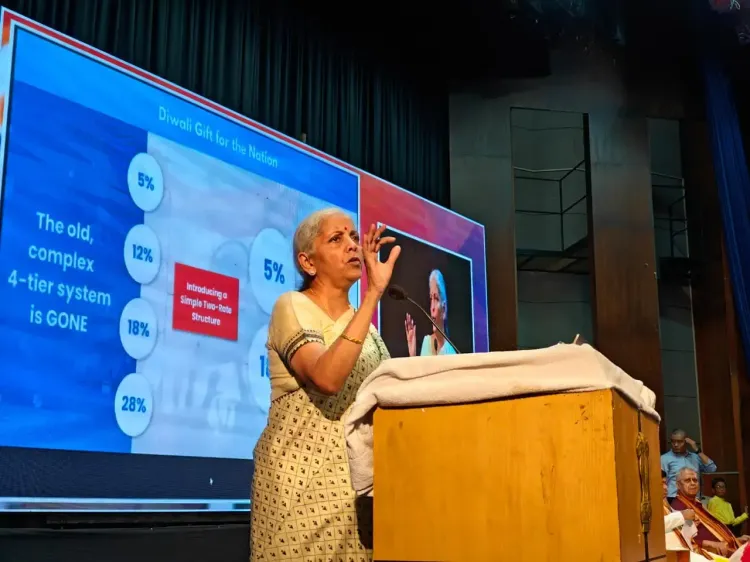

Kolkata, Sep 18 (NationPress) Union Finance Minister Nirmala Sitharaman announced on Thursday that the recent GST rate reductions would provide significant advantages to all citizens, particularly with the decrease of tax rates to 5 percent on 11 Bengal-specific items. This initiative aims to stimulate the state’s economy and support its residents.

During the GST 2.0 outreach program, Sitharaman emphasized that the reforms will be implemented starting September 22, allowing consumers to reap the benefits ahead of Durga Puja.

The tax on Shantineketan leather products has been reduced by 5 percent, and the Bankura terracotta crafts are now also taxed at 5 percent, which is expected to boost demand for these artisanal goods.

Additionally, the GST rates for Madhurkati matches and Purulia Chau masks, along with wooden masks from Dinajpur, have similarly been lowered to 5 percent.

Other items from West Bengal benefiting from these tax cuts include processed mango products from Malda and Darjeeling tea, which will now be subject to a 5 percent tax.

The decreased duties on jute bags are also anticipated to raise demand, subsequently benefitting farmers and manufacturers in the region, according to the Finance Minister.

Sitharaman noted that the tax rates were not arbitrarily set but aimed at assisting the middle class, the poor, and farmers.

The GST 2.0 reforms will further support the MSME sector, promoting economic growth and job creation throughout the country.

She also pointed out that the GST Council is a constitutional body, and states governed by the opposition, including West Bengal, have shown agreement on the recommendations concerning the reduction of GST slabs and cuts in GST rates for health schemes.

“States collaborated and supported the proposal to decrease the slabs. I personally reached out to all Finance Ministers,” she commented.

“Bureaucrats perform when there is leadership backing the system. The Prime Minister has expressed a desire for simplicity in the GST framework,” Sitharaman added.

She highlighted that the Finance Ministry is consistently reviewing rules to advance tax reforms, stating, “No one expected the personal income tax rate to be reduced.”