Are GST Reforms the Key to India's Economic Growth?

Synopsis

Key Takeaways

- GST reforms are a step forward but need further enhancement.

- India must target 10-11% economic growth for significant progress.

- Reduction of bureaucratic roles is crucial for efficiency.

- Industrialists should be viewed as partners in national development.

- Clear policies for emerging sectors like crypto, AI, and Fintech are necessary.

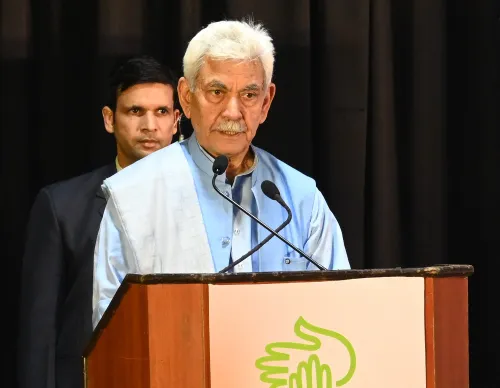

New Delhi, Sep 22 (NationPress) Political analyst Tehseen Poonawalla expressed his approval of the newly introduced reforms in the Goods and Services Tax (GST) on Monday, describing it as a “positive but small initial step” toward extensive tax and economic reform. He emphasized that for India to become the world's second largest economy, it needs to achieve a growth rate of 10-11 percent.

During his remarks made on the auspicious occasion of Navratri, Poonawalla acknowledged the good intentions behind the reforms but also raised significant concerns regarding the existing structural flaws.

“First, let me extend Navratri greetings to all my fellow Indians. We appreciate the Prime Minister's announcements. This marks the first step, albeit a modest one. Under the GST framework, there are still an excessive number of tax slabs. I find it perplexing that a 40 percent GST slab exists. If an Indian earns money and wishes to spend it, a 40 percent tax is excessively high. These slabs need to be streamlined as there is currently too much confusion in the slab system.”

Poonawalla was particularly critical of the bureaucratic management of the GST.

“The primary concern is that GST has become a tool for extortion. The officials overseeing GST are leveraging it to extract money from the public and businesses. It has shifted from being a reform tool to one of collection.”

When questioned if GST 2.0 positions India toward becoming an economic superpower, Poonawalla insisted that more comprehensive and assertive reforms are essential.

“India will advance over the next two decades. However, achieving 10–11 percent growth hinges on implementing further reforms. First, we need to reduce the bureaucratic workforce by 50 percent.”

He advocated for a shift in how industrialists are viewed in public discourse:

“We must cease regarding industrialists as adversaries. They are integral to the nation. Investment in India is vital for job creation and national progress. They should be recognized as crucial stakeholders in our future.”

He also posed critical inquiries regarding government policies related to emerging sectors.

“What is India’s stance on cryptocurrency? Is it legal or illegal? If it’s legal, how can individuals be prosecuted? If illegal, how does the government tax it? Clear policies on AI and Fintech are imperative. A forward-looking roadmap is essential.”

“Only with such measures can India aspire to become the world’s second-largest economy within 15–20 years. This transformation cannot occur with 6–7 percent growth; India must target 10–11 percent GDP growth for a significant shift.”

The recent Next Gen GST reforms, introduced this week, aim to simplify the tax structure by consolidating it into fewer slabs and lessening the tax burden on over 375 items.